- USD (USDIndex 96.70) holds on at 16-mth highs; Strong set of US data yesterday GDP (2.1%) up a tick but missed by a tick, Claims (199k) at 52-yr low, PCE (0.4% m/m & 4.1% y/y), in-line & largest since Jan.1991, along with a big beat (5.9%) for GDP Price index, Durable Goods (0.5%) in-line, Personal Spending (1.3%) a big beat, Personal Income (0.5%) a beat, Trade balance a big beat (14.6%) on strong Exports, Inventories (-2.2%) a big miss, but shows demand is strong. Consumer Sentiment a beat and New Home Sales flat (745K) and missed.

- Stocks & Yields pushed higher, Oil held onto gains and Gold tested 3-week lows.

- The FOMC Minutes showed (1) there could be a faster taper than the $15bn/mth currently planned, (2) Inflation could indeed be “persistent” (3) Clear division over 2022/23 rate hike cycle, Doves hold sway for now.

- US Yields 10yr trades at 1.644%, down from yesterday’s 1.694% high.

- Equities – Gains into the Holiday USA500 +10.76 (0.23%) at 4701 – USA500.F trades higher at 4713.

- USOil – peaked at $78.53 Inventories +1.0 vs -1.7 weakened prices – now at $77.65

- Gold found a floor at 1782, but struggles to recoup $1800 at $1790.

- FX markets – EURUSD now 1.1216, having broken 1.1200, USDJPY now 115.36, from 115.50 & Cable back to 1.3350 from 1.3315 yesterday.

Overnight – JPY PPI (1.0%) hit a 10-yr high, German GDP and consumer confidence both missed (1.7% vs 1.8% and -1.6% vs -1.0%) respectively.

European Open – December 10-yr Bund future up 16 ticks, while US futures are slightly in the red. Bunds already outperformed yesterday, as EZ spreads widened in the wake of hawkish leaning ECB comments & confirmation that German finance ministry will go to the liberal FDP, which likely means more resistance to debt mutualisation across the EZ & more pressure on ECB to limit asset purchases. DAX & FTSE 100 futures are currently up 0.4% & 0.3% respectively & US futures are posting gains of 0.3-0.4%, suggesting markets are coping quite well with the prospect of less accommodative policies. Indeed, it seems to an extent that they welcome the CB’s acknowledgement that inflation risks could be less temporary than previously thought.

Today – ECB Minutes, ECB’s Elderson, Schnabel, Lagarde and BOE’s Bailey

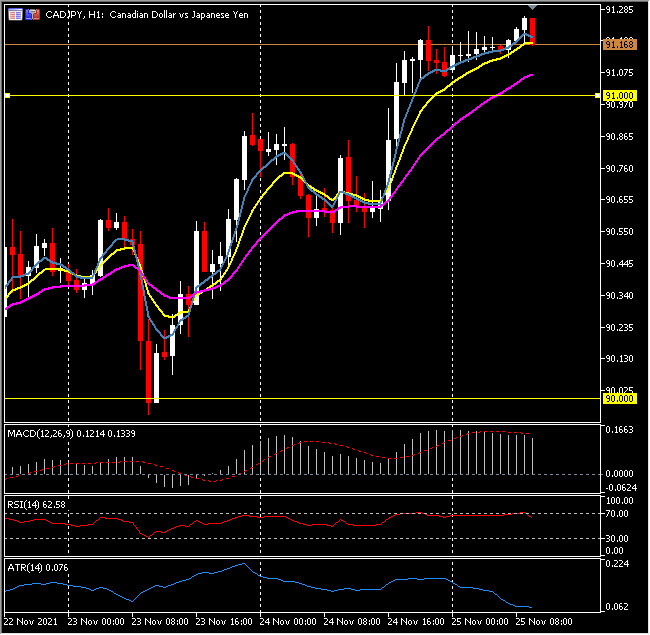

Biggest FX Mover @ (07:30 GMT) CADJPY (0.20%) The rally from Tuesday’s low under 90.00 has been sustained with 91.25 being tested earlier today. MAs aligned higher, MACD signal line & histogram rising & over 0 line, RSI 61, H1 ATR 0.077, Daily ATR 0.707.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.