- USD (USDIndex 96.30) recovers from Fridays slump (95.98), Stocks lost over –2.2% in thin half-day trading, Oil FUTS lost –13%, Gold slumped & Yields tanked (10-yr 1.482%) on a safe haven (JPY & CHF bid) risk off day. (and a strange carry trade bid for EUR). Weekend news, as Countries block flights & tighten restrictions, but first Omicron cases in SA appear mild and hospitalizations have not spiked, has seen a bounce in sentiment and Asian markets. Pfizer suggested it would take 100 days to adapt new vaccine, if required.

- US Yields 10yr trades up 5.1 bp at 1.52%, after Friday’s slump.

- Equities – tanked in thin & short day on Friday USA500 -106.84 (-2.27%) at 4594 – USA500.F trades higher at 4639.

- USOil – collapsed to $67.08 – now up nearly $4 at $71.00. OPEC+ have delayed this weeks meeting by 2 days & likely to delay planned January production increases.

- Gold spiked under $1780, has bounced to $1795 but struggles to recoup $1800

- FX markets – EURUSD now 1.1270, after a +125pip rally on Friday, USDJPY now 113.36, from 115.50 to 113.00 on Friday & Cable back to 1.3325.

Overnight – JPY Retail Sales recover but miss expectations (0.9% vs 1.2% & -0.5% last time).

European Open – The December 10-year Bund future is down -27 ticks, US futures are also in the red & the US 10-year rate is up 5.1 bp at 1.52%. Stock markets remained under pressure during the Asian part of the session, but DAX and FTSE 100 futures are up 1.2% and 1.3% respectively and a 1.2% rise in the NASDAQ is leading US futures higher. A part reversal of Friday’s flows then as virus developments remain in focus. Travel restrictions are making a come back and the services sector in particular is facing fresh pain, but as Lagarde suggested over the weekend, the impact of Omicron is unlikely to throw economies back to the situation at the start of the pandemic, meaning the overall situation has not really changed. We continue to see the ECB on course to end PEPP purchases on time in March next year, although developments will add to the arguments of those who want to keep the flexibility on the distribution of asset purchases at least for future emergencies. The BoE meanwhile may be postponing the planned rate hike into next year.

Today – German regional & national CPIs, EZ Consumer Confidence, US Pending Home Sales, ECB’s de Guindos, Schnabel, Lagarde, Fed’s Williams, Powell.

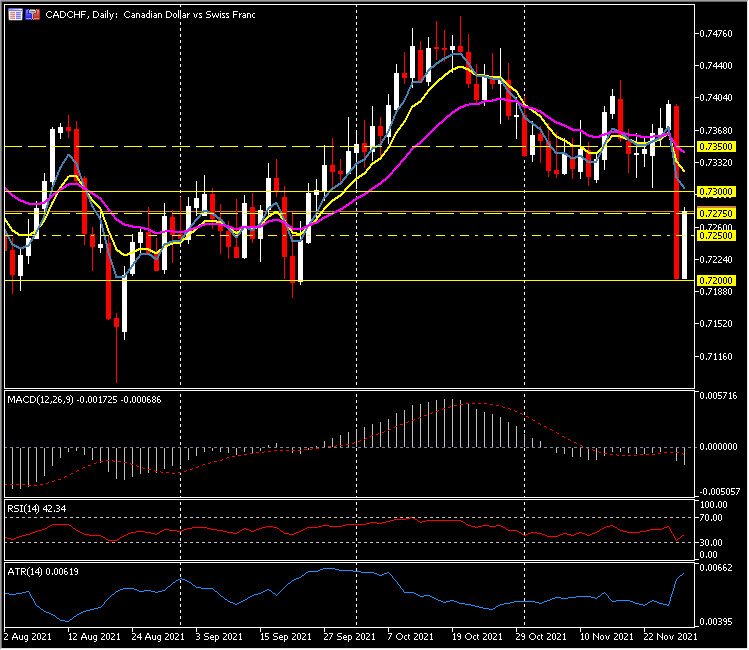

Biggest FX Mover @ (07:30 GMT) CADCHF (1.00%) The risk-off collapse on Friday 0.7400-0.7200 has recovered to 0.7280. MAs aligned higher, MACD signal line & histogram rising but still below 0 line, RSI 53.80 & rising H1 ATR 0.0018, Daily ATR 0.0062.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.