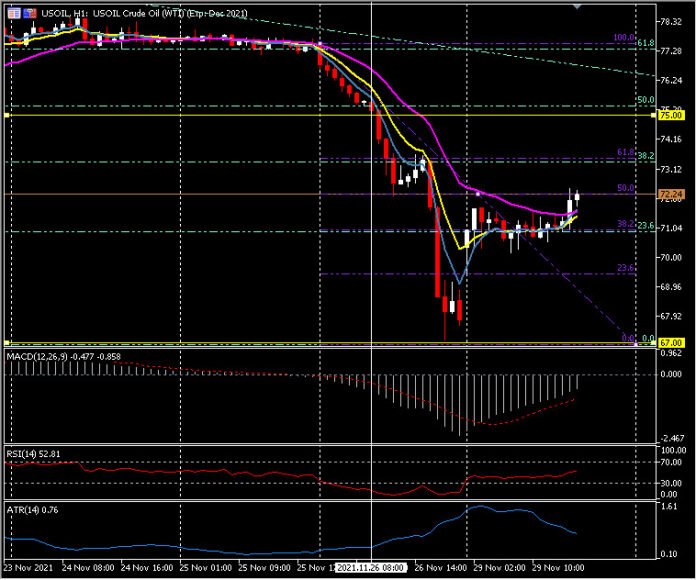

USOil, H1

Oil prices have backed up from Friday’s lows and the front end WTI future saw a high of $72.16 per barrel this morning, as markets mull OPEC action. Russia’s Deputy Prime Minister Novak said a meeting of the OPEC+ joint ministerial monitoring committee “was postponed to get more information about the current events, including the new virus strain”. After speculation of a reaction to the release of strategic oil reserves, the comments added to talk that OPEC+ may postpone the planned increase in output as Novak confirmed that the alliance will discuss “the need for measures.

OPEC’s Joint Technical Committee and the Joint Ministerial Monitoring Committee (JTC and JMMC respectively) will now meet on Wednesday and Thursday (1 and 2 December). The two committees responsibilities cover different but related areas of the market and need to be completed. The JTC’s role is to make an assessment of energy markets, the supply and demand balance, for OPEC ministers to consider when making cartel policy, whereas the JMMC tracks the compliance of OPEC+ members with their production quotas.

The USOil spot price is currently trading back at $72.24 per barrel and the Futures price at $72.40. Technically, the sell-off from Friday has now recouped the 21-hour moving average $71.50 and is testing the 50.0 Fibonacci level of the daily move at $72.20. Next resistance sits at the 61.8 Fibonacci level at $73.50, which also coincides with the 38.2 Fibonacci level of the larger decline from October highs. Above here sits the key psychological $75.00 level. Immediate support today sits at $71.00, $70.00 and then $69.45, with the Friday level of $67.00 to be watched if the OPEC meetings diverge from expectations later in the week and if more negative Omicron variant news emerges.

Also lifting Oil prices today is a JP Morgan note entitled “OPEC+ ‘Show me the Barrels’ touting possible $150/barrel price spikes by 2023, due to under investment during the last 18 months. More details can be found here:

https://www.forexlive.com/technical-analysis/!/oil-retraces-50-of-the-omicron-rout-20211129

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.