- USD (USDIndex 96.36) up, as Treasuries benefited again from the flight to safety, and as some of the oversold conditions from rate hike worries were pared. Stocks struggled after a lower close on Wall Street Friday, USA100 down over -2.0%, USA500 -0.84% to 4555 & USA30 up to 34784.

- Investors try to sort out the big risks from monetary policy, along with renewed uncertainties over Covid and the Omicron variant, and now with renewed restrictions, all the while pandemic supply/demand dislocations continue with varying impacts on growth and inflation. All this was topped off by the mixed US jobs report. The earnings season has wound down, but there has been worrisome guidance from some big tech firms.

- Traders keep a close eye on this month’s round of central bank meetings.

- Chinese Premier Li Keqiang signaled an easing of reserve requirements and China’s securities watchdog tried to play down fears over the withdrawal of Chinese companies from American exchanges.

- US Yields 10-year rate is up 4.4 bp at 1.39%. UK 10-year rate lifted 4.4 bp to 1.39%, while bond markets across the Asia Pacific region were supported and the 10-year JGB rate down -1. 2bp at 0.036%.

- USOil – steadied below 200-DMA at $68.00 – recovered from $62.24 today – rose on positive sentiment after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.-Iran talks on reviving a nuclear deal appeared to hit an impasse.

- Gold at $1780 area, as Treasury yields soften, unwinding some of the November selloff as it was seen as overdone, and as investors move back into haven trades as angst over an aggressive Fed policy posture abates and inflation concerns ease.

- FX markets – EURUSD dropped back to 1.1279, USDJPY lifted to 113.11 & Cable steadied to 1.3328. Antipodeans bounced.

European Open – The March 10-year Bund future is fractionally higher, while US futures are in the red, although in cash markets, the US 10-year rate is up 4.4 bp at 1.39%. Asian stock markets also traded mixed and sentiment is likely to continue to fluctuate. GER30 and UK100 futures are up 0.9% and 0.8% respectively and US futures are also posting broad gains, amid some hope that Omicron may turn out to be more infectious but less deadly than previous strains.

Today – Today’s data calendar had German manufacturing orders which plunged -6.9% m/m in October, much more than anticipated. BoE’s Broadbent speech is also on tap.

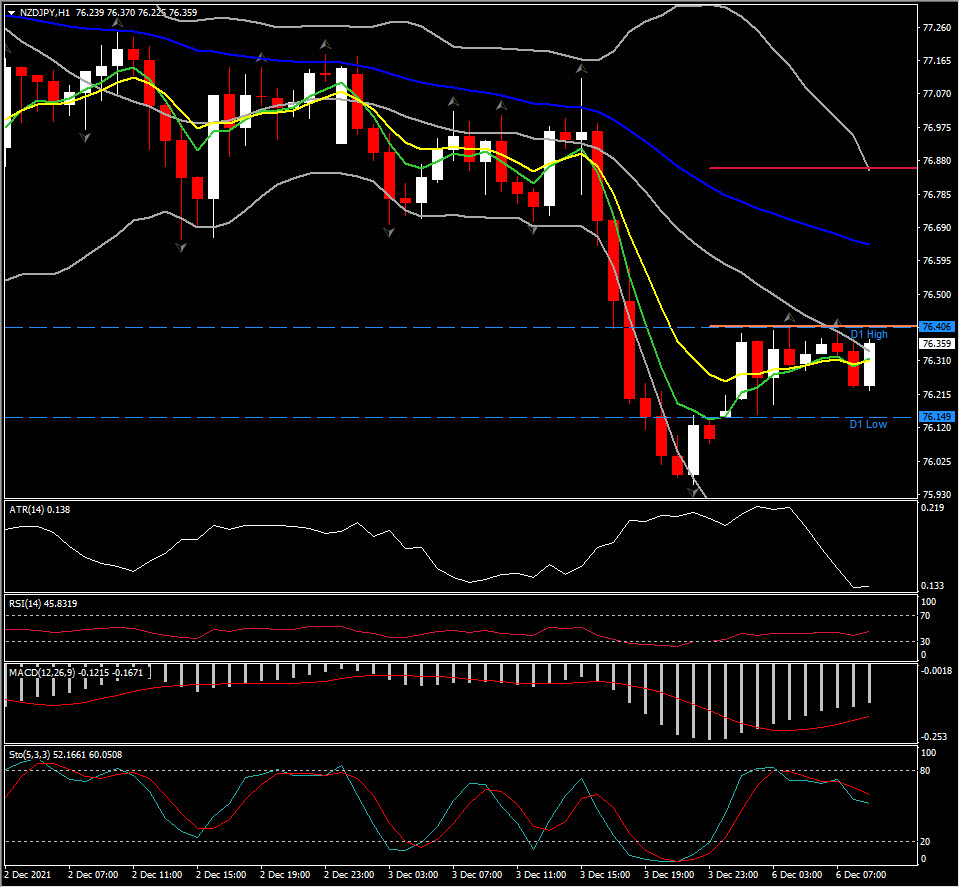

Biggest FX Mover @ (07:30 GMT) NZDJPY (+0.97%) Currently MAs flattened, MACD signal line & histogram below 0 and dipping, RSI steadied at 45, Stochastic declines. H1 ATR 0.138, Daily 0.91.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.