Gold prices against the US Dollar on Friday closed up +0.89% , while Silver against the US Dollar closed up +0.70% . Precious metal prices posted modest gains over the weekend, after a weaker-than-expected non-payrolls report fueled speculation the Fed may not accelerate its tapering move. In addition, slumping equities boosted safe-haven demand for the precious metal. Gold prices also found support from falling T-note yields, after the 10-year T-note yield fell to a 2-1/4 month low of 1.333% .

Stock indexes on Friday settled slightly lower, with the USA500 falling to a 1-1/2 month low and the USA100 sliding to a 1-1/4 month low. The plunge in tech stocks over the weekend weighed on the overall market with Adobe closing down more than -8%, Dexcom closing down -7%, Tesla closing down -6%, and Nvidia & Advanced Micro Devices closing down more than -4%. US stock indexes gathered some support, after the Senate late on Thursday passed an interim spending bill to prevent a US government shutdown. Omicron concerns also weighed, with six states reporting cases of the Omicron variant with a 7-day average of US Covid infections rising to highs of 1-3 /4 month at 100,835 on Thursday. St. Louis Fed President Bullard’s hawkish comments for the Fed’s policy impacted stock prices, when he said he supported the Fed to accelerate the pace of reductions.

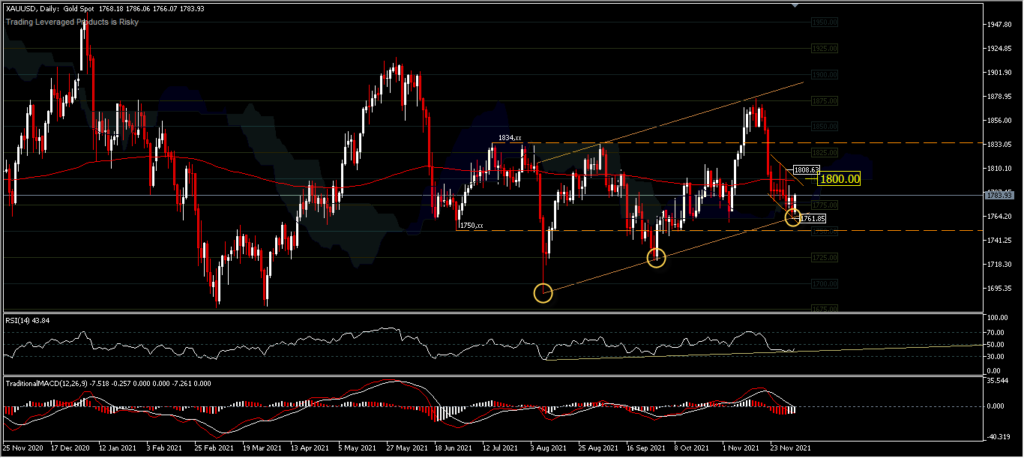

XAUUSD,D1 – The price of Gold against the US Dollar last week was traded in a range between 1761.85-1808.63 with a total decline of 0.30%. Signals favoring a rise in asset prices next week, would be a test of the trend line on the relative strength index (RSI) or a rebound from the latest low that served as minor support at 1761.85. If cancellation of the option goes up, the asset price will fall and a break of the 1761.85 price level will target 1750.00 before moving further to the 1721.59 support level and the year’s low of 1676.77.

On the upside, a break of the 1808.63 minor resistance will target the 1834.00 resistance and the asset price will have to sit back above the 1834.00 resistance to confirm the value growth. However, the price of 1800.00 will temporarily become a dynamic resistance, where we could see the 200-day exponential moving average stretch at this price level.

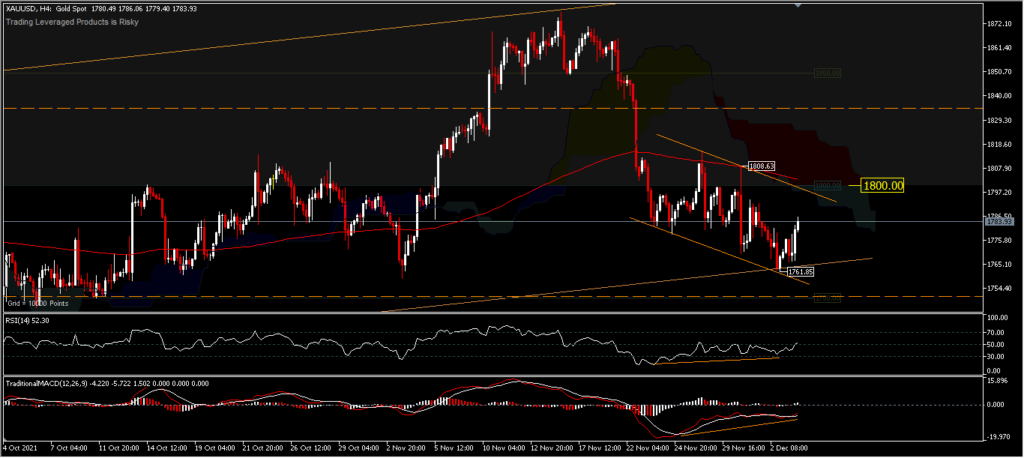

XAUUSD,H4 – Temporary intraday bias looks neutral below the round number 1,800.00 but selling pressure cannot be ignored, especially since the price is below the 200 EMA moving average. A break of the 1761.85 minor support will trigger some selling to the direction of the price is lower at 1750.00. As long as the support at 1761.81 or the lower trendline holds, it is possible that we will see some price fluctuations continue next week. On the upside, there will be need to be a test of the 1800.00 round number and 1808.63 minor resistance before being able to retest the 1834.00 resistance level . The divergence bias is clearly visible, but it cannot be used as a reference, as long as the price is still within minor resistance.

Overall, asset prices tend to be more towards consolidation which is confirmed from transaction data in the form of slim body monthly candles.

Click here to access the Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.