“The economy no longer needs increasing amounts of policy support” – Powell

Inflation “uncomfortably high” – has exceeded 2% target “for some time”

Jobs – “we are making rapid progress toward maximum employment”

Looking at a soft landing for economy, as Virus fades, Inflation dissipates on its own (2.6% 2022 – 2.1% 2024?) & Full employment (Unemployment @3.5%) runs through next 3 years.

- USD (USDIndex 96.21) rallied to 96.85 on FED weakened thereafter. Stocks rallied (Nasdaq best performer +2.15%) & Yields rallied. Omicron news mixed again with large rise in cases in UK, SA – Pfizer booster not as effective as elsewhere.

- US Yields 10yr traded up to 1.461% & holds gains.

- Equities – USA500 +75 (+1.63%) breaching key 4700 at 4709 – USA500.F trades up at 4727 knocking on the door of ATHs.

- USOil – rallied from under $70.00 to $71.41 on FED & Inventories.

- Gold held in check by higher yields & USD then reversed – sank to $1753 (46 day low) before bouncing to $1785.

- FX markets – EURUSD 1.1310 from 1.1225, USDJPY 114.10 from 114.25, Cable 1.3263 from 1.3170.

European Open – March 10-yr Bund future slightly higher, as is the Treasury future, Stock markets have taken hawkish Fed pivot in their stride and DAX and FTSE 100 are up 1.5% and 1.1% respectively ahead of European central bank meetings today. Investors welcomed the clarity on the Fed path and will also have seen the move as a sign of confidence in the recovery. In Europe, ECB is set to confirm the end of PEPP, SNB is expected to keep policy settings unchanged, BoE and Norges Bank will discuss a rate hike in the shadow of Omicron. On balance it seems more likely that Norges Bank will go ahead with the planned hike, while BoE will sit out another meeting as the country debates a circuit breaker lockdown amid 78K virus cases (highest ever) yesterday and signs it’s spreading 4x faster than Delta, fears of hospitals being overrun with cases although milder and companies suffering with many workers off sick.

Today – SNB, Norges, CBRT, BoE, ECB, Flash PMIs, US Weekly Claims – & bi-election in UK a further test of Johnson’s authority.

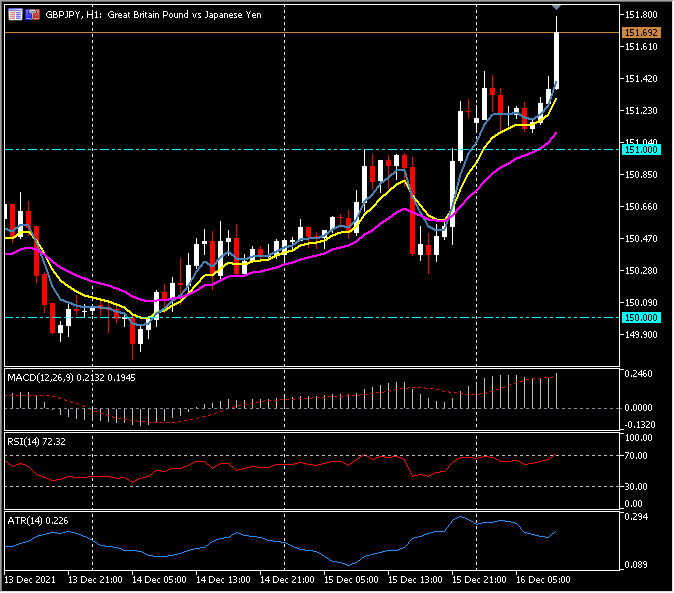

Biggest FX Mover @ (07:30 GMT) GBPJPY (+0.36%) rallied from below 150.00 on Tuesday to 151.70. MAs aligned higher, MACD signal line & histogram moving higher, RSI 72.30 OB & still rising. H1 ATR 0.225, Daily 1.20.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribited without our written permission.