- USD (USDIndex 95.80) continues to cool post FED. Stocks sank lead by Tech (Nasdaq -2.47%, wiping out Wednesdays gains) & Yields fell. A weak set of PMI’s across the globe was offset by good US Claims numbers and hot housing data. Sentiment remained depressed across Asian markets overnight, with Chinese tech stocks in particularly hit. GOLD rallied significantly. The BOE surprise lifted GBP – but Johnson lost the bi-election (a seat the party have held for 200-yrs). BOJ – No changes maintains longer JGB outlook at 0% & Inflation target @ 2%.

- US Yields 10yr traded down significantly to 1.411%

- Equities – USA500 -41 (-0.87%) unable to hold the key 4700 – at 4668 – USA500.F trades at 4660. Big losers included #TSLA -5.03%, APPL -3.93% Abode -10.19%. gainers were Verizon +4.35%, PFE +4.17% & banks lead by WFC +2.78%

- USOil – rallied again to $72.65 but has since retreated to $71.75

- Gold – BURST from range to close over $1800 ( from test of 46 day low on Wednesday at $1753) over $1805 today at $1808 currently.

- FX markets – EURUSD 1.1330, USDJPY 113.55, Cable 1.3320.

Overnight – German Producer Prices (miss at 0.8% vs 1.4% & 3.8% prior) but Bundesbank sees German Inflation @ 3.6% for 2022 vs 1.8% in June) UK Retail Sales, better than expected 1.4% vs 0.8% & 1.1% last time)

European Open – The March 10-year Bund future is up 21 ticks at 174.26, outperforming versus Treasury futures, which are fractionally higher. DAX and FTSE 100 futures are down -0.5% and US futures are also in the red, with the NASDAQ still underperforming and down -0.2%. Wall Street closed with broad losses yesterday and sentiment remained depressed across Asian markets overnight, with Chinese tech stocks in particularly hit. This week’s round of central bank decisions confirmed that banks are moving out of crisis modes and that omicron won’t prevent a gradual withdrawal of support. In Europe the BoE’s rate hike in particular send a pretty clear signal and markets will continue to digest this week’s round of meetings today. The calendar has German Ifo readings, which are likely to look pretty dismal, if yesterday’s PMI reports are anything to go by.

Today – Quad Witching; CBR Policy Announcements

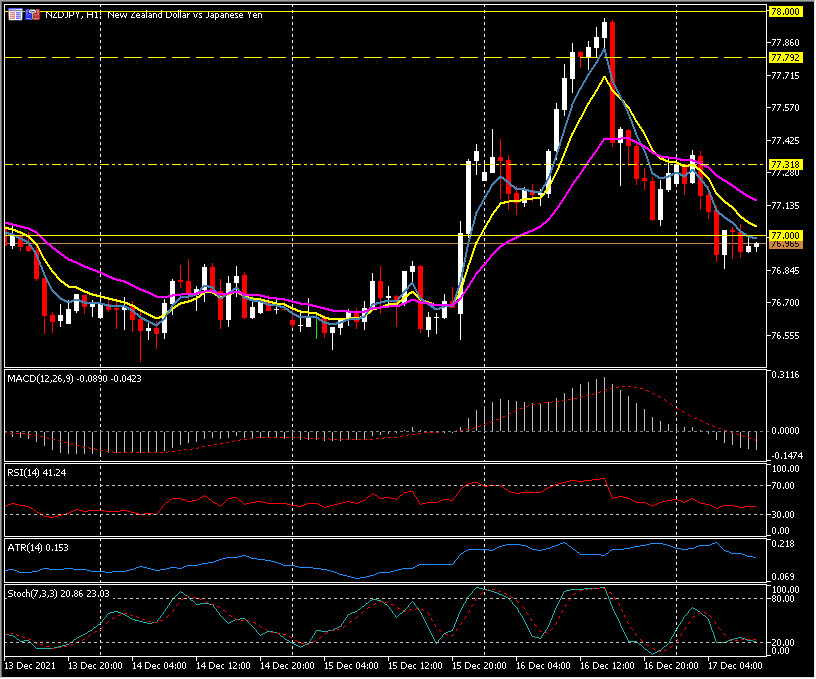

Biggest FX Mover @ (07:30 GMT) NZDJPY (-0.36%) rRejection of 78.00 yesterday is follwed by more weakness today. MAs aligned lower, MACD signal line & histogram moving lower & under 0 line, RSI 40 & falling.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.