- USD (USDIndex 96.50) held onto gains as US stocks fell over 1% again, Yields also dipped. Oil posted 2-week lows before recovering and GOLD could not hold $1800.

- Risk-off, shaken off so far today as Asian markets rally. Biden’s $1.75tn build back better bill still being resisted by Manchin but signs are more positive. Nikkei +1.79% and European & Futures rise over 1%. OMICRON – still weighs, NZ delays opening borders, UK no new measures now but cannot rule out lockdowns (probably after Christmas) – 73% of all cases in US were Omicron last week, and first death confirmed.

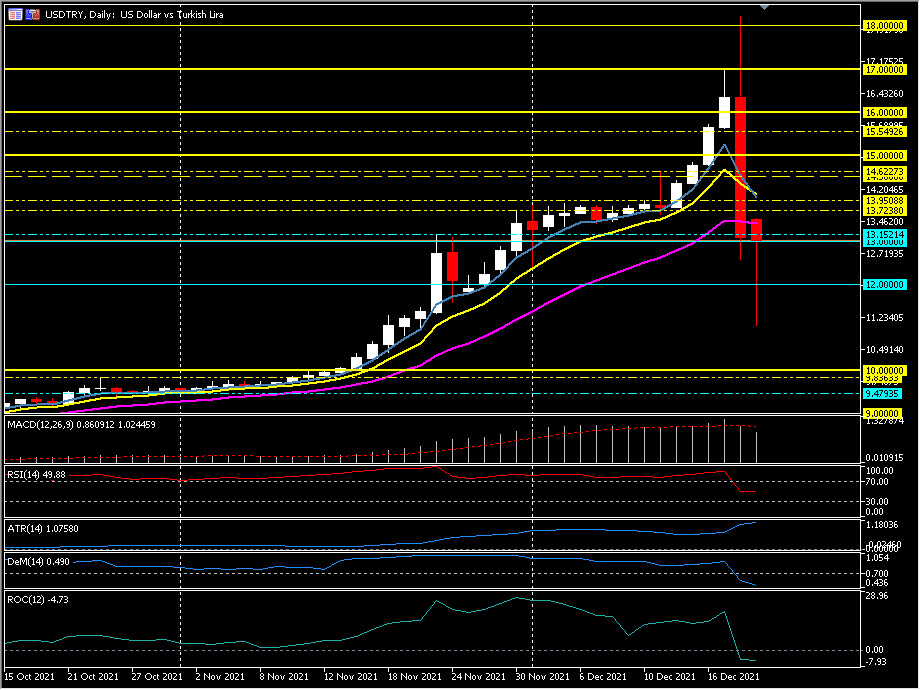

- Turkish Lira recovered +23% yesterday and another +11% today – Erdogan promised to back/guarantee local savings in LIRA (up to $1.5 billion local USD savings converted to LIRA on Monday night). Some speculators in USDTRY over 15.00 no-doubt burnt but this does not change the fundamentals of the Turkish economy and 20%+ inflation-rate. Move in USDTRY off lows today at 13.60.

- US Yields 10yr traded down to 1.419% now 1.43% lifted as market sentiment improved and save haven flows were reversed.

- Equities – USA500 -52 (-1.14%) at 4568 Dow & Nasdaq -1.23% – USA500.F trades up at 4593. Nike & Micron beat earnings significantly, Movers; PFE +2.6%, MRNA -6.25%

- USOil – slumped to $65.88 yesterday bounced to $69.00 now as sentiment lifts

- Gold – Could not hold the key $1800 handle yesterday & tested 1788 again, now up at 1790.

- FX markets – EURUSD 1.1275 from a test of 1.1300, USDJPY 113.72, Cable tested down to 1.3173, recovered to 1.3215 after no new restrictions announced.

Overnight – RBA Minutes – confirmed worries over Covid-19, Inflation and “Committed to maintaining highly supportive monetary conditions.”

European Open – The March 10-year Bund future is down -33 ticks, underperforming versus Treasuries, which are also in the red. DAX and FTSE 100 are up 1.2%, and a 1.2% rise in the NASDAQ future is leading US markets higher, after a broad rebound across Asian markets. Omicron and the associated comeback of restrictions remain in focus, but the general feeling is that developments will dent, but not derail the recovery.

Today – German GfK Consumer Sentiment, EZ Consumer Confidence (Flash).

Biggest FX Mover @ (07:30 GMT) NZDJPY (+0.31%) Bounced from 76.00 lows yesterday to 76.40 now. MAs now aligned higher, MACD signal line & histogram moving higher but still under 0 line since early Friday, RSI 52 & rising, Stochs OB zone. H1 ATR 0.125 Daily ATR 0.714.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.