The risk of needing to stay in hospital for patients with the Omicron variant of COVID-19 is 40% to 45% lower than for patients with the Delta variant – Imperial College, London

“The unpredictable path of the pandemic and its related impacts on growth and inflation continue to dominate investor risk appetite,” – Invesco

- USD (USDIndex 96.00) sinks to key level as US stocks rallied again and Yields also rose; USOil breached $72.00 and Gold broke $1800 as the USD weakened. Risk back on, & a weaker JPY & CHF in rather low volume markets. Asian markets also higher again. OMICRON; signs of market boredom continues – Inflation a bigger risk than Covid-19 the mantra for 2022.

- US Yields 10yr traded up to 1.457% and trades at 1.46% now

- Equities – USA500 +47 (+1.02%) at 4696 (still below key 4700) NASDAQ +1.18%, – USA500.F trades up at 4698. #TSLA +7.49% (Musk said he’d sold all the shares he is selling – for now) APPL +1.53%, GOOGL +2%

- USOil – rallied again – inventories -4.7m barrels vs -2.4m peaked at $72.76, as sentiment lifts, the low inventories and increasing demand.

- Gold – broke $1800 on the weaker USD, holds 1805 level now.

- FX markets – EURUSD 1.1328, USDJPY rallies to 114.25, Cable to 1.3363

European Open – German import price inflation jumped to 24.7% y/y in November, from 21.7% y/y in the previous month. The March 10-year Bund future is down 7 ticks, slightly underperforming U.S. futures. More pressure then for bonds, which already declined yesterday as stock markets improved. However, while governments in Berlin and London have shied away from “canceling Christmas” with even tighter restrictions, more virus measures are underway for next week to prevent a spike in the number of those forced into quarantine disrupting essential services. DAX and FTSE 100 futures are currently posting gains of around 0.5%, Hawkish comments from ECB’s Schnabel yesterday highlighted that even the ECB is on the way to phase out stimulus now, even though it will continue to lag Fed and BoE. Trading is likely to start to dry up ahead of the holiday weekend, which in Germany and the U.S. essentially starts tomorrow and in the U.K. is extended until next Tuesday.

Today – US Personal Income, Consumption, PCE Price Index, Durable Goods, New Home Sales

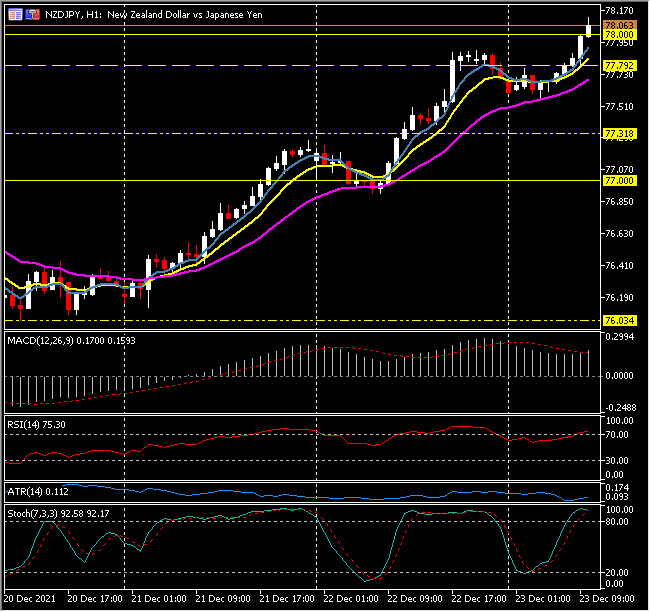

Biggest FX Mover @ (07:30 GMT) NZDJPY (+0.46%) Continues the rally from Tuesday as JPY weakens on budget announcements, breached 78.00 now. MAs aligned higher, MACD signal line & histogram higher, RSI & Stochs OB, H1 ATR 0.112 Daily ATR 0.7500.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.