Japan’s growth forecast was raised to 3.2% for the 2022 fiscal year from the 2.2% real GDP growth forecast seen at the mid-year review in July, helped by a record additional stimulus budget approved by parliament this week. This will be the fastest growth since fiscal 2010 when the economy grew 3.3% after the global financial crisis.

Stimulus spending is expected to boost GDP by 1.5% this fiscal year and 3.6% next fiscal. But the government lowered its forecast for Japan’s real GDP to 2.6% in the current fiscal year, which ended in March from 3.7% previously, as the prolonged COVID-19 pandemic and chip supply constraints weigh on the recovery.

Japan’s economy, the world’s third largest, experienced an annualized contraction of 3.6% in the July-September quarter following a resurgence of COVID-19 cases, curbing private consumption which accounts for more than half of GDP.¹

USDJPY rallied +0.04% yesterday to a 3½ week high as safe-haven demand for the Yen was capped, after Japan’s Nikkei Stock Index closed +0.16% higher. The Yen also came under pressure Wednesday after the minutes of the BOJ’s October meeting said the Yen’s weakness had had a positive impact on the overall economy. Meanwhile the Yen weakened against the Euro yesterday by 0.4%, continuing the upward movement for the 3rd day.

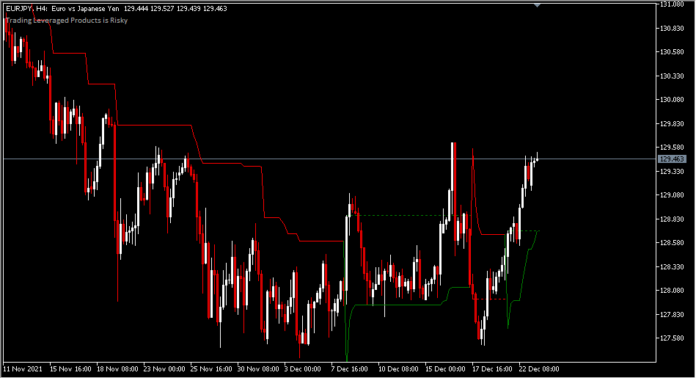

EURJPY,H4

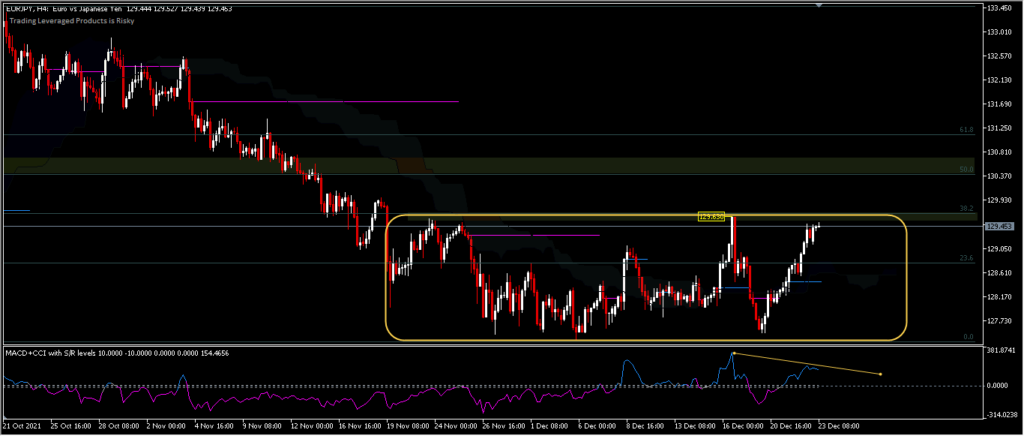

EURJPY,H4

The asset is currently trading below the resistance level of 129.63, gaining 0.2% in the Asian session. Technically, a break of the resistance level would bring the bias to the upside at the 50.0% (130.40) retracement level. However, as long as resistance persists, the asset is likely to re-consolidate within a bound price range. And a break of the support at 127.37 will confirm the continuation of the correction wave for a move to the downside at the 126.00 price level. Overall these assets are likely to consolidate, yesterday’s gains fueled by inflationary pressures in Europe which lifted the 10-year German bond yields to a 3½ week high of -0.269%. France’s Nov PPI was up +17.4% y/y, the biggest gain since the data series began in 1996. The ECB’s Hawkish comments on Wednesday also supported the EUR after ECB Governing Council member Rehn said the ECB “will respond” if inflation picks up high.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.