Wall Street’s main indexes posted solid gains for a third straight session on Thursday, with the S&P 500 marking a record-high close, as encouraging developments gave investors more ease about the economic impact of the Omicron coronavirus variant. – RTS

- USD (USDIndex 96.00) weakened again and is having its worst week since September. US stocks rallied again to new highs, Yields also rose; USOil & Gold both held on to healthy gains. Risk on for Santa as strong US data and good Omicron news lifted sentiment. Asian markets grind higher again.

- US Yields 10yr traded closed at 1.4903%, having breached 1.50%

- Equities – USA500 +29 (+0.62%) at 4725 (0.5% above key 4700) NASDAQ +085%, #TSLA +5.76% Eli Lilly +2.48%, PFE -1.41% – For the week, the S&P 500 rose +2.3%, the Dow gained about +1.7% and the Nasdaq climbed +3.2%. S&P Futures were up 0.66%.

- USOil – rallied again $73.54, before settling at 73.32

- Gold – spiked to $1810 on the weaker USD, and holds at 1808

- Bitcoin rallied +4.5% with the risk-on mood, breaching 50k and trades at 51k now

- FX markets – EURUSD 1.1325, USDJPY holds up at 114.34, Cable breached 1.3400 and trades at 1.3410 now.

Today – Germany closed today & Monday, UK half-day today and closed Monday & Tuesday. US markets closed today, re-open Monday.

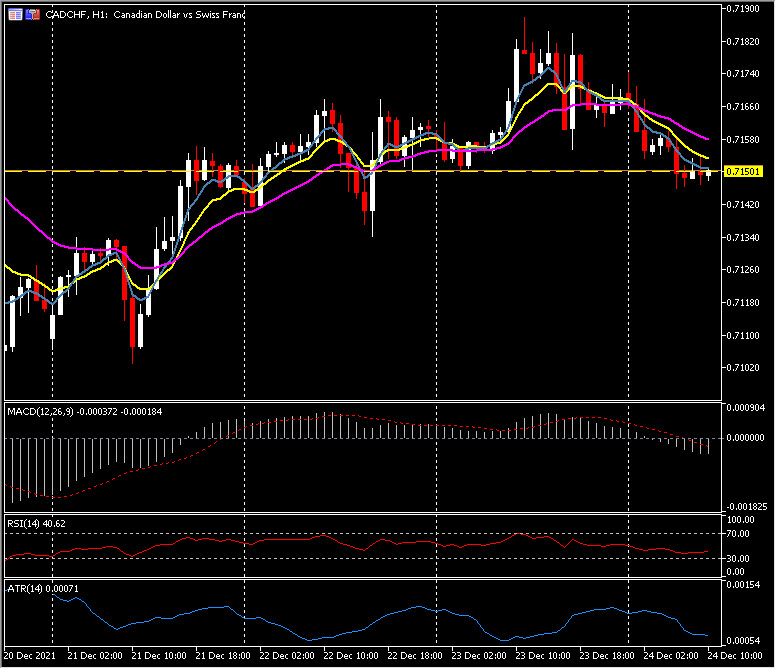

Biggest FX Mover @ (07:30 GMT) CADCHF (-0.37%) Rejected rally to 0.7200 yesterday having topped at 0.7180, trades down to 0.7150 now. MAs aligned lower, MACD signal line & histogram lower and now below 0 line. RSI 40.62 and falling, H1 ATR 0.0007 Daily ATR 0.0052.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.