Stock markets were narrowly mixed across Asia in cautious trade, with Australia and Hong Kong among the markets still closed for the extended holiday weekend. In Europe, the UK is still on holiday and in North America Canada will remain shut today.

- USD (USDIndex 96.20) steady within 96-96.25 area. US stocks sustain gains in contrast to Asia stocks which corrected lower despite further promises of support for the economy from officials in Beijing. Yields also rose; USOil & Gold under refreshed pressure.

- Japan retail sales came in stronger than anticipated – the government last week announced more stimulus measures that also include a direct handout to families, which is boosting the chances of a consumption led recovery, although Omicron could still derail that scenario.

- US Yields 10yr has corrected -1.7 bp to 1.48%, as US Treasuries have found buyers.

- Equities – USA500 settled at 4730 (0.5% above key 4700), NASDAQ at 16344, USA30 at 35950, GER30 future is down -0.3%, Nikkei corrected -0.37%.

- USOil – reversed from $73.58, to 72.34, after airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases, though Brent crude gained support from hopes that the Omicron variant will have limited impact on global demand. The contract did not trade on Friday because of the US market holiday.

- Gold – steady above $1,805 as weaker US yields counter firmer Dollar.

- FX markets – Yen struggled,USDJPY lifted to 114.68, EURUSD 1.1317, Cable trades at 1.3400.

Today – The data calendar is pretty empty on both sides of the Atlantic, which will leave investors mulling virus developments and central bank outlooks, with early trading suggesting a cautious backdrop and limited moves.

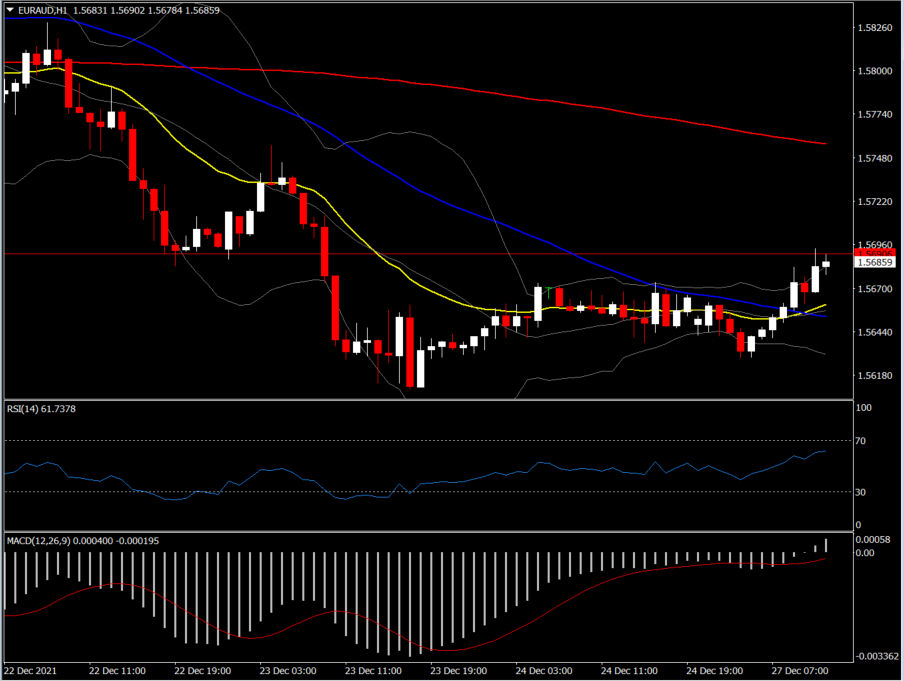

Biggest FX Mover @ (07:30 GMT) EURAUD (+0.60%) Breached 1.5692, breaking the 20- and 50-hours SMA, which have been bullish. MACD signal line & histogram turned positive. RSI 61.73 and rising.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.