- The Global stock market rally ran out of steam, with Asian markets trading mixed, in combination with year end malaise taking its toll. There was little to no inspiration to drive yields one way or another, leaving rates little changed on the day, but with a curve flattener intact. The USD (USDIndex 96.37) was supported.

- US Yields 10yr has corrected -0.7 bp to 1.47%, as the rally on stocks ran out of steam during Asian hours.

- Tech stocks drove the decline in Hong Kong as markets eye Beijing’s tightening oversight, while China’s property slowdown remains a concern. Bloomberg highlighted that a key gauge of interbank funding costs fell to the lowest level since January, after the central bank added more cash to the financial system – to ease an expected surge in seasonal demand for liquidity.

- Equities – Nikkei down -0.6%, Hang Seng has lost -1.0% as the lockdown in Xian city to curb the spread of COVID-19 continued for the seventh day. The USA100 surged 1.39% while the USA30 rallied 0.98%, just shy of their historic peaks from November. GER30 future is down -0.2% and the UK100 is up 0.6% in catch up trade.

- USOil – at 75.96 as it remains supported and is trading close to a 1-month high after a Bloomberg story saying the American Petroleum Institute reported crude holdings fell by 3.1 million barrels last week. Official data are due later today, but the report is already underpinning prices.

- Gold – down to $1,801.

- FX markets – USD was supported with USDJPY stuck below the psychological 115.00 level at 114.89, EURUSD dipped under1.1300, Cable dropped back to 1.3414.

- Turkish Lira was down around 2% at 12 per US Dollar on the day, bringing losses so far this week to 12%. The beleaguered currency had rebounded more than 50% from record lows around 18 last week, after the country announced some support measures.

Today – The calendar remains light with just the November advance goods trade, wholesale and retail inventory reports, pending home sales, and weekly MBA mortgage numbers and oil inventories.

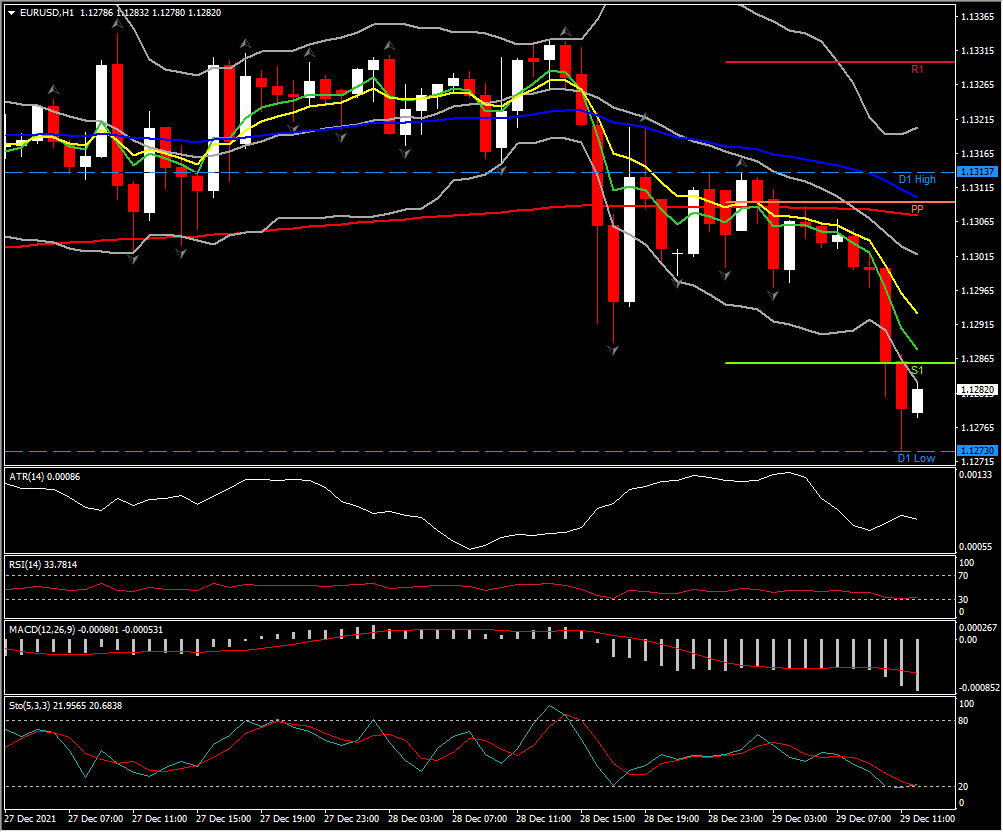

Biggest FX Mover @ (10:30 GMT) EURUSD (-0.24%) has dipped under the 1.13, turning below S1, with fast MAs pointing downwards, RSI flirting with the OS barrier and MACD signal line & histogram negatively configured.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.