2022 has finally begun and most prominent will be the shift to policy normalization from the core central banks. Of course there are a lot of questions for investors in 2022, including covid uncertainties, the pace of monetary policy normalization, inflation, growth versus value, and the Chinese regulatory crackdown, along with various geopolitical risks. But the markets are currently focused on this week’s heavy calendar full of key data, including the OPEC+ meeting, the US jobs report and FOMC minutes.

The robustness in US growth, on top of elevated and persistent inflation pressures, caused a dramatic pivot from the FOMC last fall as its policy went from uber-accommodative to three rate hikes in 2022 in a matter of a couple of months. The markets priced in three tightenings for this year and the Fed’s dots in the December SEP followed that lead. Attention will be on upcoming data to help determine the timing of liftoff with Fed funds reflecting the potential for liftoff as soon as May.

The December nonfarm payroll report will be eagerly awaited as it is a focal point for the Fed’s policy stance. Reflecting the improvement in the labor market, payrolls have now reclaimed 83% of the jobs lost in March and April of 2020, while hours-worked have reclaimed a larger 93% of the drop. The speed of the recovery surprised the Fed and factored into the move to taper and to quicken the pace last month. We expect further gains in December with a 440k increase, after increases of 210k in November, 546k in October, and 379k in September. The jobless rate should hold steady at 4.2% for a second month, down from 4.6% in October. Hours-worked are projected rising 0.2%, while the workweek ticks down to 34.7 from 34.8 in November. Average hourly earnings are assumed to rise 0.4%, after gains of 0.3% in November and 0.4% in October. But the y/y wage gain should ease to 4.2% from 4.8% due to a hard comparison.

The manufacturing ISM index tomorrow is expected to dip to a still solid 60.5 in December after rising 0.3 ticks to 61.1 in November. The index is only modestly off of the 18-year high of 64.7 from March. The December ISM-NMI index, on Thursday, is expected to fall to 66.0 following the 2.4 point rise to an all-time high 69.1 in November. Even with the dips, we expect the data, including the various regional reports, to still leave an optimistic overall sentiment path. Indeed, most measures remained at or near record highs through Q4 as inventory rebuilding and supply chain disruptions are allowing factories to enjoy elevated pricing power.

Along with the tier-one data, Fedspeak is back with a couple of policymakers speaking at the American Economic Association annual meeting this week. The highlights will be comments from Bullard, one of the most hawkish on the FOMC, and who rotates into voting status this year. He will discuss monetary policy and the economy on Thursday. Daly, a more dovish nonvoter, also speaks on policy on an AEA panel on Friday. Bostic is also on tap. The FOMC minutes to the December 13-14 policy meeting on Wednesday will be scrutinized for further insight into the Fed’s pivot and the jump in dots to show 3 rate hikes this year.

But how all these could affect US Dollar this week ?

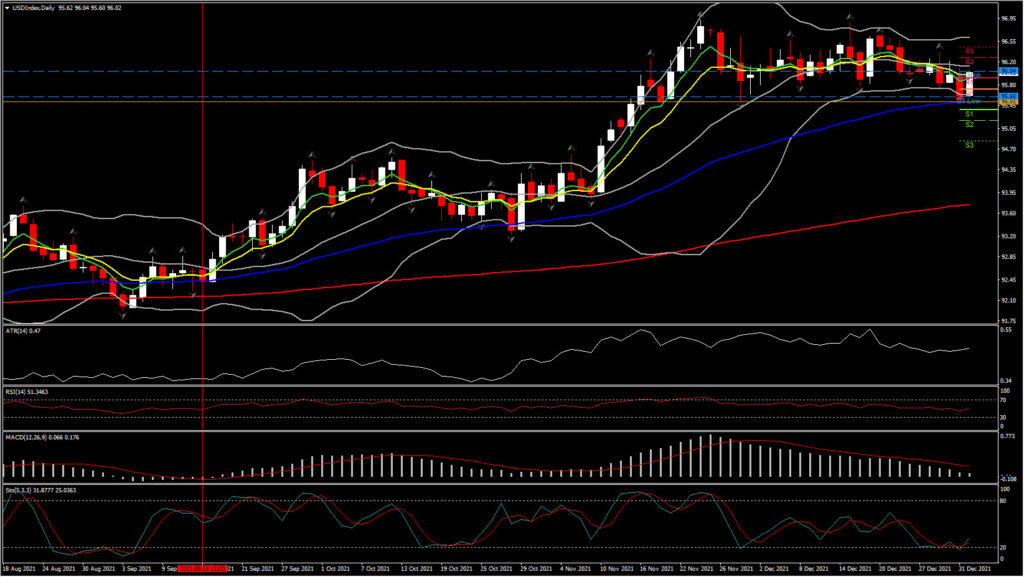

Currently the US Dollar has ticked up higher against majors as an upbeat market mood today lifted equities and government bond yields for the first day of trading of 2022. Bourses are solidly in the green with the CAC 40 powering to a 1.18% gain, and the GER30 0.93% higher. The USDIndex has bounced to 96 from 95.55 lows, leaving the 95.50 support (50-day SMA) untouched for more than 2 months.

Even though the technical side points to a ranging market for the asset, as the MAs and BB have flattened implying consolidation, along with RSI and MACD which are close to zero, from a fundamental perspective this week’s FOMC minutes and jobs could boost the Dollar. Another strong report will be enough to confirm to the Fed once again the further growth in the economy and employment, while also reducing inflation.

Omicron also remains a key driver, although there are lingering hopes that a mutation that is more infectious but leads to fewer hospitalisations means the end of the pandemic is in sight. That has helped and is expected to continue helping stocks, government bond yields and the US Dollar as the risk trade turns lower.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.