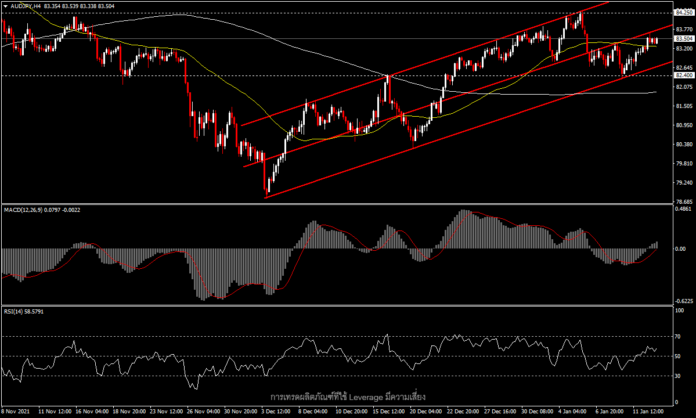

AUDJPY, H4

Australia’s November retail figures continued to record higher, at 7.3%, above the 3.9% market forecast and above the 4.9% rise in October. It also holds the record for the fourth strongest retail figure since the data began being collected. Meanwhile Australia’s trade surplus in November declined to A$9.42 billion from 10.78 billion (revised from 11.22 billion) in October amid rising commodity prices.

As a result, the S&P/ASX 200 stock index rose 0.33% this morning, led by mining and energy stocks, while the Australian Dollar has strengthened this week against the US Dollar. After Fed Chair Powell’s testimony before the Senate that failed to signal a rate hike as expected, the AUDUSD pair is now hitting a new nearly two-month high in the 0.7292 zone.

In Japan the November account surplus was sharply reduced to 897.3 billion yen from the 1,732.3 billion yen seen in the same period a year earlier. The Nikkei 225 index fell -0.94% today with Covid cases still rising hitting a four-month high of 13,000, while the USDJPY pair is now holding onto a two-week low of 114.40 after the US Dollar fell hard yesterday.

From a technical point of view, the AUDJPY pair in the H4 timeframe maintains its positive outlook that has been seen since December. The price is still fixed in the uptrend channel, resting above the MA50. The MACD line is above 0 and RSI is now above the 50 level, with 58 the main resistance at the high of the year at the 84.25 zone. However, if the price falls below the MA50 at 83.25 there could be a pickup in the low zone of the year at 82.40.

For the rest of this week’s economic calendar there are two major releases from Japan: today’s preliminary estimates for machine orders and tomorrow’s PPI figures.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.