The market has well priced in elevated inflation and an all but assured March rate liftoff, hence taking in stride a record clip in core PPI at 8.3% y/y and the drop in continuing jobless claims to 1,559k, the lowest since before the pandemic. Markets trimmed long positions and deemed, for now, that several US rate hikes this year are fully priced in.

- USD (USDIndex 94.73) – found a floor above 94.50.

- US Yields 10-yr has lifted 2.0 bp to 1.72% overnight, as hawkish Fedspeak continued to fuel tightening speculation. – Fed Brainard acknowledged that she too could vote for a March rate hike.

- The Bank of Korea added to the hawkish tone by hiking the key rate to 1.25% from 1.00% and signalling that more moves could be on the way. Bank of Japan is deliberating how it can start telegraphing an eventual rate hike. – Yen on bid.

- China’s trade data showed a marked slowdown in both export and import growth.

- Equities – tightening speculation has put pressure on stocks. GER30 and UK100 are down -0.4%. USA100 dropped -2.5%, JPN225 corrected -1.3%.

- UK economy stronger than expected before Omicron. Monthly GDP data for November were a positive surprise, with a rise of 0.9% m/m that compensated somewhat for the disappointing October reading.

- USOil – at 81.68 after 80.75 bottom, amid concerns on Chinese fuel demand & whether US government will act to cool oil prices.

- Gold & Silver – best weekly rise since November – remains however below the key $1835 barrier.

- FX markets – EURUSD at 1.1482, USDJPY down at 113.63, Cable at 1.3725.

European Open: The March 10-year Bund future is down -6 ticks, broadly in line with moves in Treasury futures, while both the Schatz and the 30-year futures outperformed. The UK already signalled that virus measures will be relaxed further in coming weeks, which will add to the arguments of the hawkish camp at the BoE.

Today –Headlining is the ECB Lagarde speech and US December retail sales report.

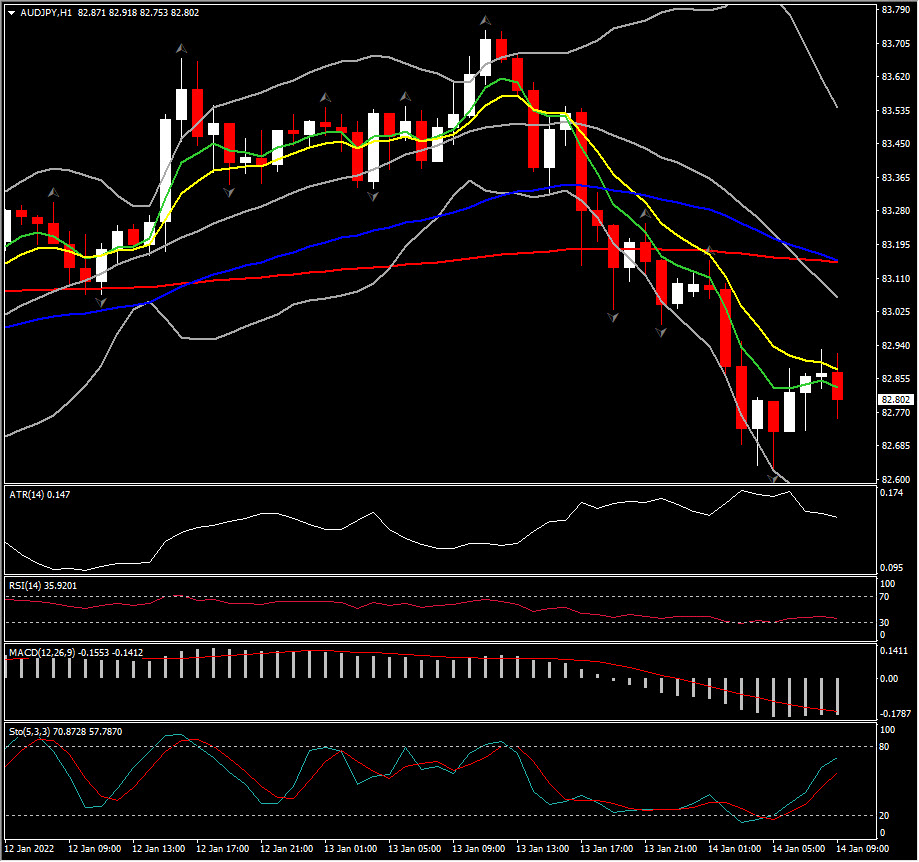

Biggest FX Mover @ (09:30 GMT) AUDJPY (-0.40%) breaks below 20-day SMA at 82.60 (50-DMA). Fast MAs aligned lower, with MACD lines negatively configured, RSI at 36 but stochastics pointing higher suggesting correction.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.