Asian markets weaker as BOJ stays put (-0.1% interest rate) with stimulus package intact, raises inflation target to 1.1% and growth to 3.8% for 2022. Kuroda: “Will ease monetary policy without hesitation as needed, there has been a notable improvement in the economy.” USD firmer, Yields moved up with US 2-yr over key 1.0%, 10-yr over 1.8%. Oil higher – Saudi’s retaliate, attacking Yemen and Gold holds at $1815.

- USD (USDIndex 95.25) holds on to gains from Friday, pushing to 953.8 earlier.

- US Yields 10-yr moved higher again and trades at 1.818%.

- Equities – US closed yesterday. Nikkei -0.27% – USA500 FUTS lower again at 4633.

- USOil – Spiked over $84.70 as very tight supply, Saudi’s retaliation on Sanaa and NK continued firing of missiles unsettles sentiment.

- Gold – holds at $1815 from a test of $1823.

- Bitcoin another down day, tested to $41,600, back to 42,200 now.

- FX markets – EURUSD back to 1.1400, USDJPY now 114.80 tested 115.00 earlier, Cable back to test 200hr MA 1.3620, +20 pips after UK jobs data.

Overnight – UK Earnings in line at 4.2%, Unemployment (4.1%) and Claims better than expected. PBOC deputy governor says will keep yuan exchange rate basically stable.

European Open – The March 10-year Bund future is down -19 ticks, Treasury futures are underperforming. Stocks across Asia struggled with the renewed rise in yields and DAX and FTSE 100 futures are also down -0.3% and -0.2% respectively. Inflation risks and central bank outlook will be dominating the discussion in coming months.

Today – German ZEW, Empire State Manu. Index & Earnings from Goldman Sachs. Day 2 of DAVOS (on-line).

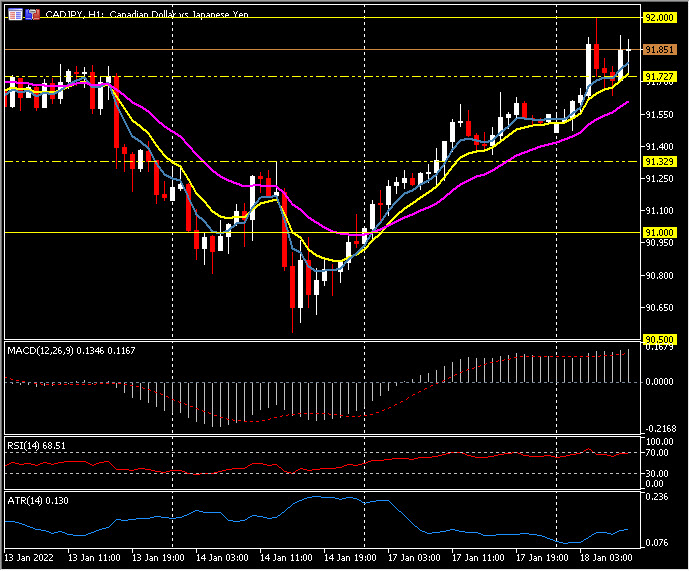

Biggest FX Mover @ (07:30 GMT) CADJPY (again) (+0.34% again) Rallied all day over 91.73 (Thursdays high) and onto test 92.00. MAs aligned higher, MACD signal line & histogram higher & above 0 line. RSI 68 rising, H1 ATR 0.131 Daily ATR 0.804.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.