The world’s leading streaming service and production company NETFLIX (#Netflix), with a market capitalization of $239.57 billion , is expected to announce its fourth quarter 2021 financial results and business outlook on Thursday January 20, 2022 after the market close.

The report will be for the fiscal quarter ending Dec 2021. In the fiscal third quarter of 2021 which ended on 30th September 2021 and reported on 19th October 2021, the company’s revenue was 7.48 billion dollars and the net income was 1.45 billion dollars also in the same period, while the earnings per share stood at 3.19, surpassing analysts’ forecasts of 2.57/2.56. These figures were clearly higher than the ones for the same period in 2020 (revenue 6.44 billion dollars; net income of 789.98 million dollars; earnings per share 1.74). At the moment according to a Yahoo Finance survey of 35 analysts, the forecasted earnings average estimate is 0.82 per share and average revenue is estimated to come in at 7.71 billion dollars.

Investors will be paying attention to whether Netflix added more new subscribers in the 4thquarter compared to the 4.4 million subscriber growth in the third quarter thanks to the roll out of content that was delayed in the first half of 2021 due to the COVID-19 pandemic. Also of note to investors is the fact that in the past 3 months Netflix has underperformed the market (USA500 index) having fallen 15% compared to an 8% rise in the Index.

It is also important to note that the content streaming market in the United States is becoming saturated and therefore going forward Netflix will have to compete for subscribers, for example with the likes of HBO Max which has long been considered a pacesetter of premium content. In that regard Netflix’s recent move to raise its monthly subscription price in Canada and the US by $1 to $2 gives its competitors an edge in the content streaming business.

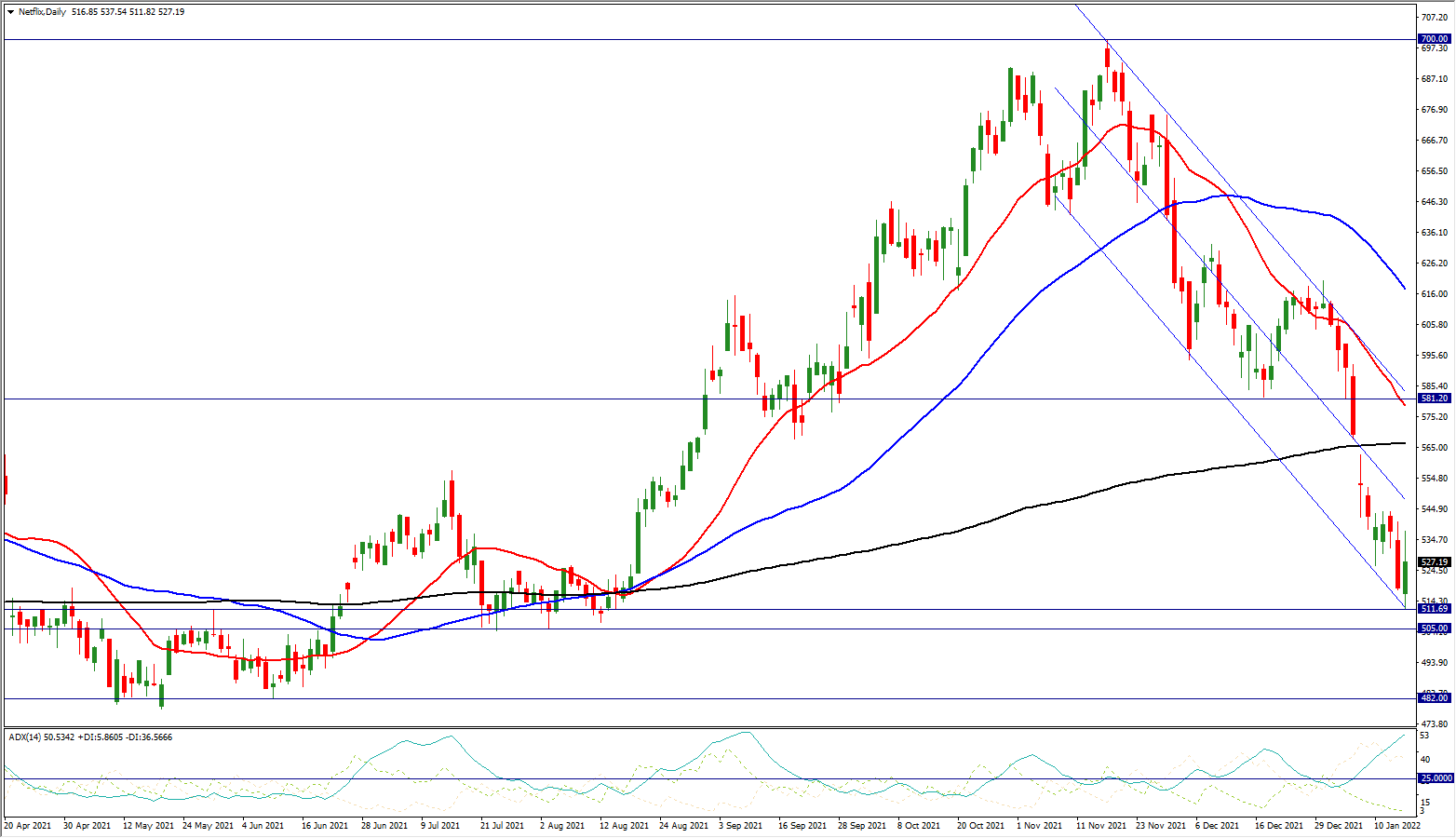

Technically, Netflix price action on the daily timeframe chart is trending downwards trading below the 50 (blue), 20 (red) and 200 (black) simple moving average having come off a high at $700.20. The ADX is above 25.00, clearly indicating that the stock price is in a strong downtrend. Currently, the stock price has found support at the lower trend-line of a channel pattern at 511.69. More downside target can be anticipated at 505.17 after a major swing low in August last year, and then 482.00. A bounce in price action from these levels will be met by resistance at the 200 SMA, while last month’s swing low at 581.18 which acted as support is anticipated to become resistance and a break above this level which is apparently a confluence point with the upper trendline of the channel will act as a sign of a potential reversal of the current downtrend.

Click here to view the economic calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.