It was all about risk aversion and a flight to safety in the markets to end the week. Concerns over Ukraine-Russia tensions added to the bearish backdrop as the hawkish turn at the FOMC and other central banks, along with the worries over inflation, as well as earnings as the impacts of surging expenses on the bottom line take their toll.Meanwhile, the PBoC is going the other way as it looks to shore up its slumping economy. China’s central bank just cut its 14-day reverse repo rate and added more stimulus after cutting the 7-day rate last Monday, along with the reduction in the 1-year medium term loan rate. This is providing some support to Chinese stocks and that could underpin some follow-through dip buying into Western equity markets

Additionally, many of the high flying pandemic companies are crumbling, led by the weakness in Netflix and Peloton. The 10-year Treasury rate is at 1.76%, the German Bund rate at -0.065%, both slightly lower. USD firmed Gold held onto to gains.

- Preliminary PMI readings for Japan showed a struggling services sector, but ongoing improvement in manufacturing, which left the composite in contraction territory for the first time since September 2021.

- Australia’s composite plunged to 45.3 from 54.9.

- China’s PBOC provided 14-day funds at a 10 bp lower rate, which was no surprise after last week’s slew of rate cuts as the country battles Covid-19 and troubles in the property sector.

- USD (USDIndex 95.75) ticks higher.

- Equities – USA500 dips to 4419 – USA500 and USA100 posted their biggest weekly drop since March 2020 last week.

- USOil – rebounded to $85.00 but holds below it.

- Gold – held on to gains topped at $1841 and holds at 7-week rally.

- Bitcoin under $35,000 handle – its lowest since July 2021.

- FX markets – EURUSD back to test 1.1300 – 1.1326, USDJPY now 113.60 (The Japanese yen tends to benefit from safe haven flows as stocks crumble) & Cable eased to 1.3550, below 20-DMA.

European Open – GER40 and UK100 futures are posting slight gains, as are US futures, with tech stocks leading the way. Markets struggled overnight, but while European PMI readings this morning are likely to look similarly weak than data out of Japan and Australia overnight, in the current situation that also backs hopes of a cautious stance at central banks, as the FOMC announcement on Wednesday comes into view.

Today – Today’s local calendar focuses on preliminary PMI readings for the Eurozone and UK, which are expected to reflect the impact of virus measures on the services industry, especially in the Eurozone. Today’s schedule includes earnings from IBM, Southern Copper, Halliburton, Brown & Brown, Logitech, and Steel Dynamics. The data slate is light, with December Chicago Fed national activity index, along with flash January Markit manufacturing and services PMIs. The Treasury auctions $54 bln of 2-year notes.

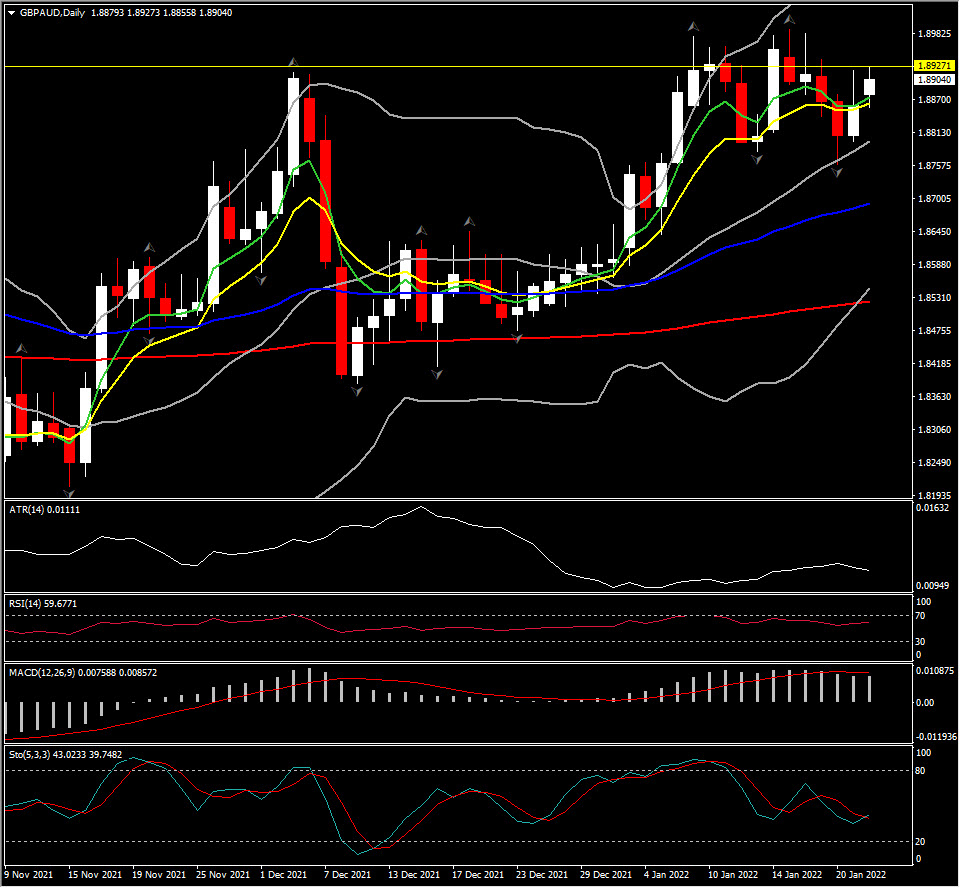

Biggest FX Mover @ (07:30 GMT) GBPAUD (+0.41%) Topped to 1.8927 extending Friday’s gains. Currently settled to 1.8900 barrier. MAs flattened along with RSI, but MACD signal line & histogram hold higher, while Stochastic points lower. H1 ATR 0.0024 Daily ATR 0.0111.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.