It was a wild Tuesday in the lead up to today’s FOMC decision. Both bonds and stocks closed lower as the Fed is widely expected to outline a rate hike strategy with a 25 bp liftoff in March. Exaggerated fears of a 50 bp move and perhaps a string of 4 to 5 hikes this year have dissipated, though we suspect the markets are still positioned too bearishly. We expect the policy statement and Fed Chair Powell’s press conference to be less hawkish than anticipated, hence setting the markets up for a bit of a relief rally.

So far today, Bonds have struggled, stocks hit the skids again in the US session but eased in the Asia session, and FX markets have remained in a narrow range as markets wait for the FOMC and BoC. Australia was on holiday, which made for somewhat lower volumes, but it was mainly the upcoming FOMC announcement that put a lid on markets. Ukraine tensions and speculation over gas supplies to Europe in case of an escalation of tensions with Russia are weighing on sentiment. UK PM Boris Johnson now has to answer the police over “partygate”, with calls for him to resign getting louder.

- USD (USDIndex 96) continues incline – 3rd day above 20-DMA.

- The 10-year Treasury rate is up 0.4 bp at 1.773%. The 10-year JGB rate is also slightly higher, but the 2-year paper found buyers as the BoJ summary shows commitment to loose policy. – The bank’s stance focused on providing stimulus to reach the 2% inflation goal.

- Treasury’s $55 bln 5-year auction was super strong.

- Equities – The USA100’s -3.18% drop paced the weakness, followed by a -2.8% loss on the USA500 and a -2.3% decline on the USA30. Today, Topix and Nikkei corrected -0.25% and -0.44%, GER40 and UK100 futures are up 0.66% and 0.84% respectively, while the Euro Stoxx 50 is 0.7% higher.

- Earnings: General Electric, beat on earnings, but missed on revenue, which weighed heavily while American Express provided upside support on solid earnings led by record credit card spending. Microsoft beats expectations with $18.8bn profit.

- Central banks clearly are getting nervous about the risk of second round effects, but the IMF’s growth downgrades yesterday also highlighted the risks from slowing momentum in China and virus developments.

- USOil – up to $84.60 – API data shows US crude stocks fall,Biden threatens sanctions on Putin over any invasion, markets await Fed update, US approves oil exchange from strategic reserve. Yemen’s Iran-aligned Houthi movement launched a missile attack on a United Arab Emirates base hosting the US military.

- Gold – down to $1844 from $1854.

- Bitcoin at $37,000 handle.

- FX markets – USDJPY steady at 113.95. EURUSD at 1.1295 & Cable at 1.3500.

European Open – Bund futures are under pressure, while US futures are moving higher, while in cash markets, the German 10-year Bund yield has lifted 0.4 bp to -0.08%. BTPs are supported though and spreads are coming in.

Today – Along with today’s BoC and FOMC result, the earnings calendar is heavy. Today’s slate features several biggies, including Tesla, Abbott Labs, Intel, AT&T, Boeing, Anthem, ServiceNow, ADP, Lam Research, Crown Castle, Norfolk Southern, Freeport-McMoran, Progressive, Kimberly-Clark, Amphenol, Ameriprise, Corning, Nasdaq, Hess, Teradyne, Seagate, United Rentals, Raymond James, and Teledyne. Data includes the December advance goods trade report

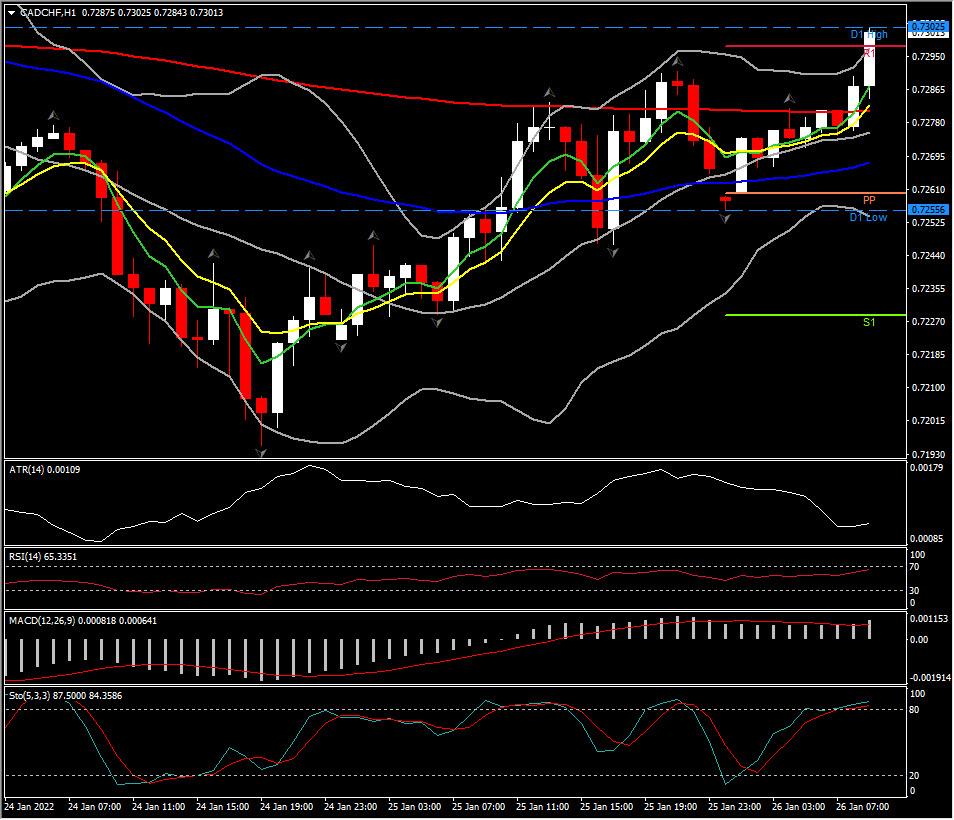

Biggest FX Mover @ (07:30 GMT) CADCHF – Breaks 0.7300 (R1) from 0.7195 lows on Monday. Fast MAs aligned lower intraday with all momentum indicators pointing further higher.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.