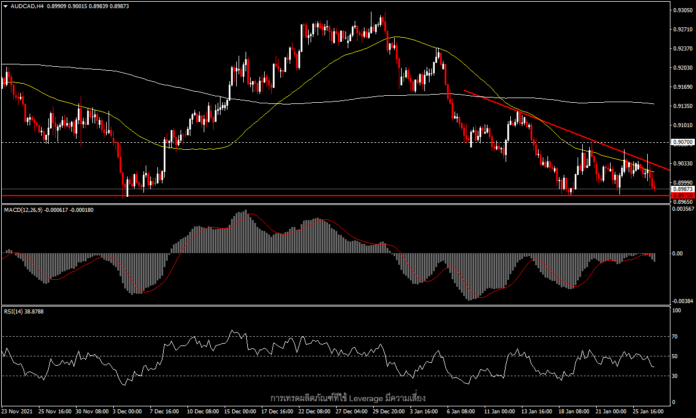

AUDCAD, H4

The RBA will have its next interest rate decision meeting next week, on Tuesday February 1. The interest rate was kept at 0.1% in December, and while it is not yet possible for the RBA to decide how and when bond purchases of A$4 billion should fall, it will depend heavily on employment, inflation and spending data. The latest Q4 2021 inflation report was up 3.5% year over year from 3% in Q3 and above the 3.2% expected by the market, while the quarterly CPI was 1.3%, the highest in the past five quarters. This was mainly due to the increase in oil prices and global supply chain problems.

The Australian S&P/ASX 200 stock index was down -1.9% at 6,829 this morning, after the Fed last night showed a clear stance of raising interest rates in March with the end of its QE program, boosting stocks in the tech sector. Although there was a biotech decline In Australia’s economic data this morning, import prices for the fourth quarter of 2021 rose for the fourth quarter at 5.8% and export prices rose for the fifth consecutive quarter at 3.5%.

On the Canadian side, the BoC yesterday announced it kept interest rates unchanged at 0.25% at its first meeting of 2022, and dismissed previously provided guidance to maintain interest rates at a low level, as the overall economy is getting better. This will pave the way for the first rate hike since 2018.

Technically, AUDCAD is testing the 2021 low zone into the second week. As a result, in the H4 timeframe, a round descending triangle is seen where prices are below the MA50 line and are in line with the falling MACD in negative territory and the RSI at 41, so if the price breaks the previous low of 0.8975 there will be next support at the 161.8 Fibonacci level at 0.8780 (drawn from the December lows). Conversely, if the price is able to regain above the MA50, there will be next resistance at 0.9070 and the MA200 at the 0.9140 zone.

Click here to view the economic calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.