Wall Street giant Alphabet Inc. is expected to report its fourth quarter 2021 financial report on February 1, 2022 after the market closes. Alphabet Inc., better known as Google, is among the four largest companies on the Dow Jones stock exchange, alongside Apple, Microsoft and Amazon, with a market value of $1.713 trillion. Alphabet Company Inc. owns and operates Google, YouTube, Google Cloud (GCP), Waze, Fitbit and many other companies, with Google, YouTube and GCP its biggest businesses.

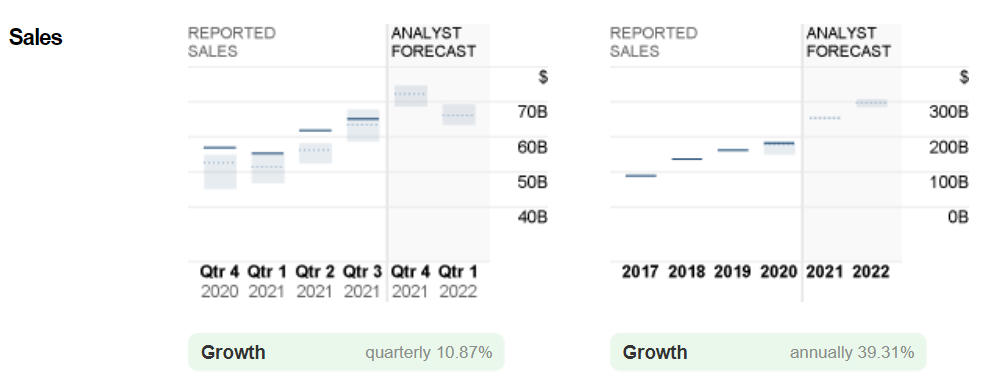

Alphabet Inc. has consistently reported better than expected earnings over the past 4 quarters, as well as better than expected sales reports and earnings per share (EPS). In its third-quarter 2021 financial report last October, Alphabet reported earnings per share (EPS) at $27.99 per share vs. $23.48 per share, and sales revenue of $65.12 billion vs. $63.34 billion (source: CNBC). Alphabet’s primary revenue is from advertising on YouTube, Google Cloud services, and Cost of Traffic Acquisition (TAC). Alphabet consistently reported revenue of $182 billion in the first 9 months of 2021, a 44.4% increase from the $126 billion in revenue reported in the same period last year following increased demand in the advertising sector after the economy reopened and through the post-Covid-19 recovery.

Source: CNN Money

Investors are now focused on whether Alphabet Inc can maintain consistency and deliver an excellent report in this fourth quarter financial report. A market consensus report from CNN Money expects Alphabet Inc. will announce an increase in sales return of $72.2 billion from $65.1 billion in the third quarter and an expected total sales revenue for 2021 of $254.8 billion. Meanwhile, the consensus EPS return is expected to be announced at $27.70 per share, down slightly from the $27.99 return per share in the third quarter. The annual return per share is expected to rise to $114.22 per share.

Technically, #Alphabet shares saw an increase of 69% throughout 2021 but the overall stock exchange crash in January caused #Alphabet shares to fall nearly 15% from a high of $3036 and close on January 28 at $2583. The lowest price of #Alphabet in 2022 so far was $2490. The #Alphabet price is currently slightly above the 23.6% weekly fib retracement support level and is still below the 50-week MA. The stock price movement is still quite negative this week with the psychological level of $2600 being the nearest resistance while $2550 is the nearest support for daily trading. The RSI has risen from the oversold zone area but is still hovering slightly at the reading of 30. The MACD indicator is still in the bottom area.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.