PayPal Holdings, Inc. (#PayPal) is scheduled to release its earnings for the fiscal Quarter ending Dec 2021 on 1st February (Tuesday), after market close.

In general, the largest digital payment platform under-performed in 2021, with its share price closing down 63% off its highs ($309.47) seen in July. Reasons the price fell include slowdown of revenue growth, rising expenses, disappointing company sales guidance for 2022, performance not on par with the market’s elevated expectations, overvaluation etc.

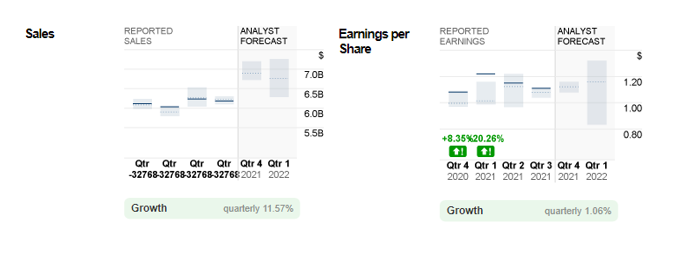

Figure 1: Reported Sales and EPS versus Analyst Forecast for PayPal. Source: money.cnn

In the upcoming Q4 report, consensus estimates for sales stand at $6.9B, up over 11% (q/q) and 13% (y/y) respectively, whilst EPS is expected to hit $1.12, up 0.9% (q/q) and 3.7% (y/y). Despite undergoing a heavy sell-off till today, analysts remain a strong buy rating on the company. A detailed explanation on the stock’s valuation has been done by Cramer in terms of CAGR estimates: the CAGR is valued at +4.10%, rating PayPal a “Hold” in contrast to most analysts, as CAGR estimates rate a company a “Buy” if the CAGR is above 12%, or a “Sell” if the CAGR is below 4%.

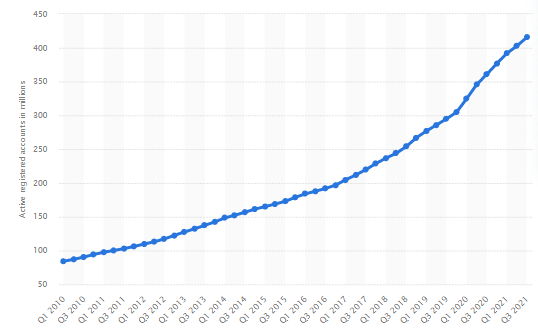

Figure 2: Number of PayPal’s Total Active User Accounts from Q1 2010 to Q3 2021 (in millions). Source: Statista

According to MBLM’s study on brand intimacy based on emotional connections in the second year of the pandemic, PayPal has been ranked second in the financial industry, outpacing its competitors such as Visa and Mastercard, as well as other major banks. This suggests PayPal remains a strong preference for most consumers considering the positive emotional connections that have been established. Up to Q3 2021, number of PayPal active users reached 416 million, up over 4.9 times from Q1 2010.

Also, there are a few research-based fundamental metrics that may support the positive outlook for PayPal, such as high EPS rating (82/99) and an A SMR rating (representing the top 20% of companies).

In November last year, PayPal announced a team up with Amazon, allowing the latter’s US clients to pay with Venmo (a mobile payment service owned by PayPal). Besides the usual money-transfer services, Venmo also offers an in-app cryptocurrencies buying/selling service, which may help in further improving the company’s competitiveness in the financial sector.

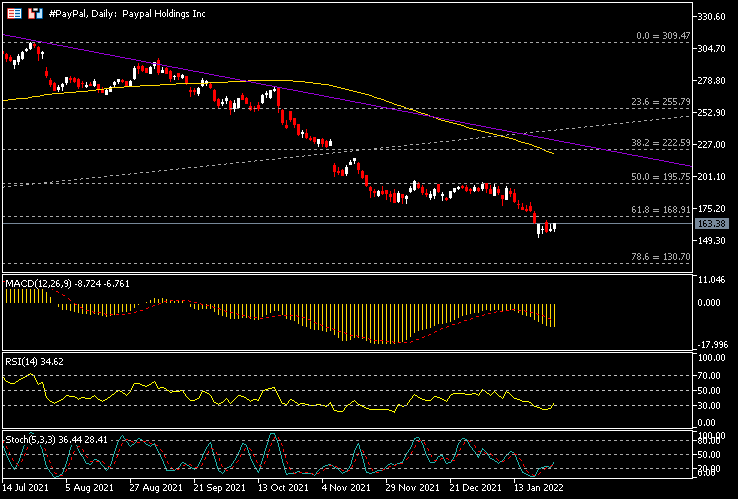

#PayPal has been traded in a strong downtrend since its failure to break above $310 in July 2021. To date, the company’s share price has pared its gains by 47.2%, below $168.90 (FR 61.8%). This level serves as an immediate resistance. Based on the indicators, MACD fast and slow lines hovered below 0 line, while RSI and Stochastics showed signs of rebound from the oversold zone. If a bullish breakout is successful, the next target should be $195.75 (FR 50.0%) and $222.60 (FR 38.2%). The latter also intersects with 100-day SMA and the downtrend line – a strong confluence zone in which a break above may indicate a change in the current trend direction. On the other hand, if bearish pressure persists, the first support is $130.70 (FR 78.6%). Breaking below this level would open up an opportunity for the share price to continue testing the psychological level $100, and the lows in March 2020 at $82.

Click here to view the economic calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.