Stock markets closed higher after a weak start (S&P500 +0.94%) Mixed PMI data, a huge miss (-301k) for ADP & record CPI (5.1%) in Europe hung on sentiment. Asia markets struggled too. Weak earnings from Meta, Spotify and a -24% decline for PayPal. USD & Yields consolidate, Oil holds on to gains & Gold holds over $1800. Biden ordered 3000 troops to Eastern Europe.

China, Hong Kong and other markets remained closed for the Lunar (Tiger) New Year holidays.

- USD (USDIndex 96.10) up from 95.77 low, 96.00 remains a key level

- US Yields 10-yr closed at 1.766 & trades at 1.766%.

- Equities – USA500 +43 (+0.94%) 4589 – (PYPL -24.59%, GOOG +7.45%) USA500 FUTS slip 4538. META lost +20% after hours,

- USOil – Spiked over $88.00 on OPEC+ maintaining 400k/day output. Now $86.32 after inventory drawdown

- Gold – topped at $1810 back to $1802 now.

- Bitcoin remains under $40,000 back to test $37,000

- FX markets – EURUSD up to 1.1295 USDJPY up to 114.60 & Cable to 1.3550

Overnight – Japan Services PMI missed, large rise in AUD Imports & Building Approvals.

European Open – The December 10-year Bund future is up 6 ticks at 168.72, slightly outperforming versus Treasury futures, as risk aversion picks up again amid disappointing reports from tech bellwethers that weighed on stock market sentiment. DAX and FTSE 100 futures are down -0.4% and -0.3% and a -2.3% sell off in the NASDAQ is leading US futures lower.

European markets closed mixed though yesterday, after another record setting inflation report for the EZ put pressure on ECB ahead of today’s announcement.

Final services PMIs for the Eurozone and the UK are likely to highlight that virus developments continued to weigh on the sector at the start of the year, but officials are increasingly optimistic that economies will bounce back quickly from the most recent virus variant. Against that background, the spike in inflation is starting to look worrying, especially as labour markets continue to tighten.

The BoE is widely expected to deliver another rate hike today, while the ECB could well sound more hawkish than some expect.

Today – EZ, UK & US Services PMI, Weekly Initial Claims, Factory Orders & ISM Services PMI, BoE & ECB. Earnings Amazon, Eli Lilly, Biogen, ConocoPhillips, Penn, BT, Shell, Nokia, ING, Infineon.

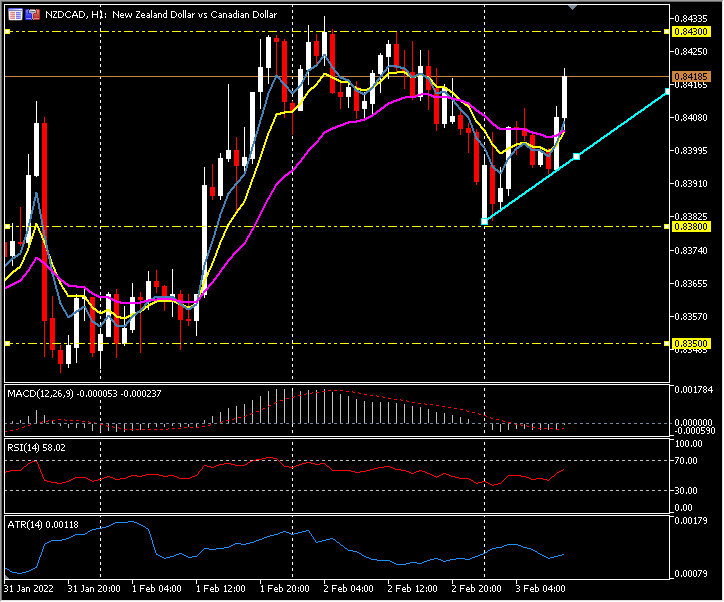

Biggest FX Mover @ (07:30 GMT) NZDCAD (+0.30%) Rallied from key 0.8380 to 0.8415 now. MAs aligned higher, MACD signal line & histogram rising but under 0 line, RSI 58 & rising, H1 ATR 0.0012 Daily ATR 0.0059.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.