Global computer software giant NVIDIA Corp. will announce revenue results for the 4th quarter of 2021 on February 16, 2022 after the market closes. The report will be published online. The Nvidia company was founded in 1993 and is now based in California with a current market value of $600 billion.

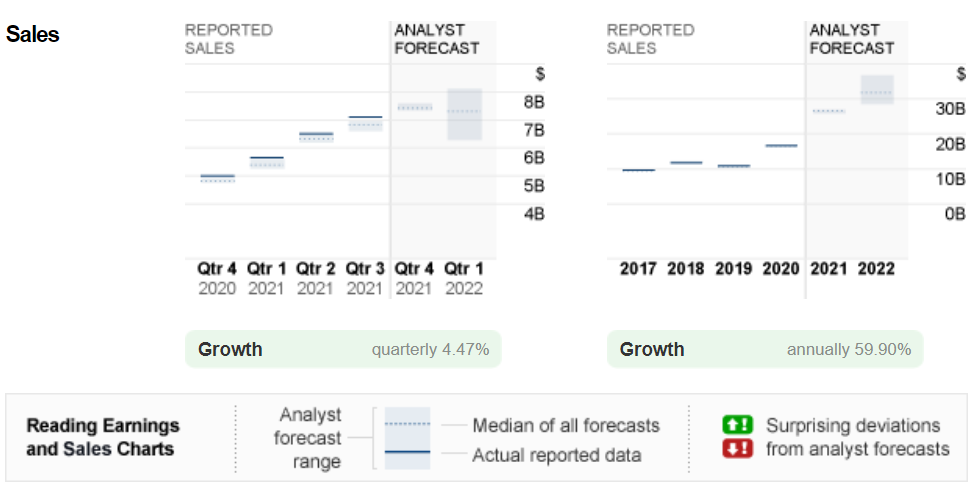

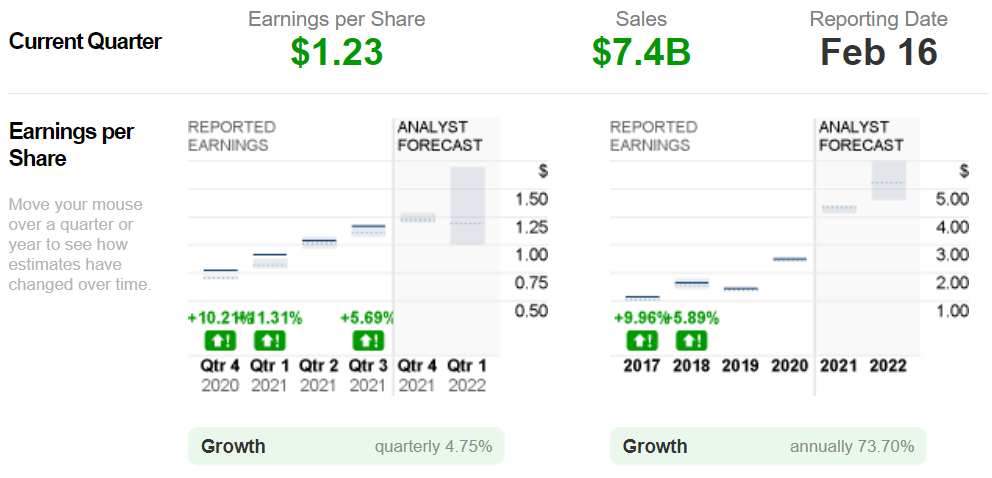

In its last earnings report for the 3rd quarter 2021, Nvidia posted a positive report with revenue of $7.10 billion, up 9% from the 2nd quarter. The main revenue is contributed by the gaming division, data centers and professional visualization platforms of the market. The rate of return per share (EPS) was reported at $1.09, up from $0.89 in the 2nd quarter.

For the 4th quarter earnings report on Feb. 16, the market expects Nvidia will continue to report healthier earnings and exceed analysts ’expectations. Market analyst CNN Business expects the company to report revenue of $7.4 billion, up more than 48% from the same quarter a year earlier, while EPS is expected at $1.23 compared to $0.78 in the same quarter of 2020. The gaming division is expected to be a major contributor to the company’s revenue. The concentration of global companies in using online storage (cloud system) is expected to also help to increase the company’s revenue. Although the latest report said that Nvidia has canceled its intention to take over the car chip company Arm owned by SoftBank following regulatory issues, this is not expected to affect market confidence in Nvidia. Nvidia has consistently exceeded market expectations in its quarterly earnings report since 2019 as reported by Zacks.

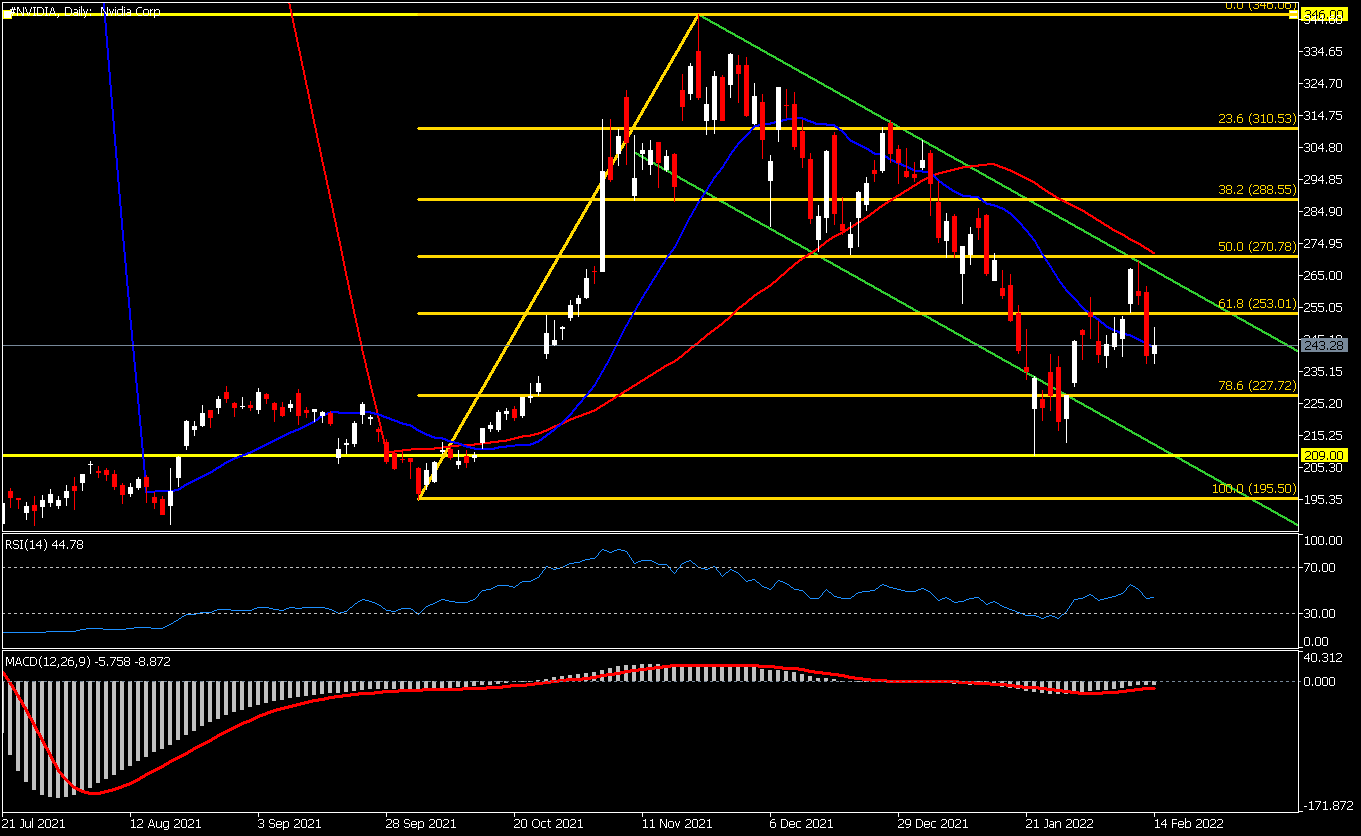

Nvidia shares have continued to show positive gains since its stock split in July 2021. #NVIDIA shares are currently trading at $243.28, down from a November 2021 high of $346. The fall in stocks since the beginning of 2022 was contributed by several factors including the fall of the US stock exchange, the hawkish intonation of the FED and the risk off situation in the market due to geopolitical issues and high inflation. The nearest resistance is currently at the 20-day SMA at $245, followed by resistance at $270 which is also close to the 50-day SMA. The nearest support is at the 2022 low at $209, with the October 2020 low at $195.50 being the next support. The RSI(14( is still below the 50 reading but is now quite flat and the MACD line is below the 0 level but also flat.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.