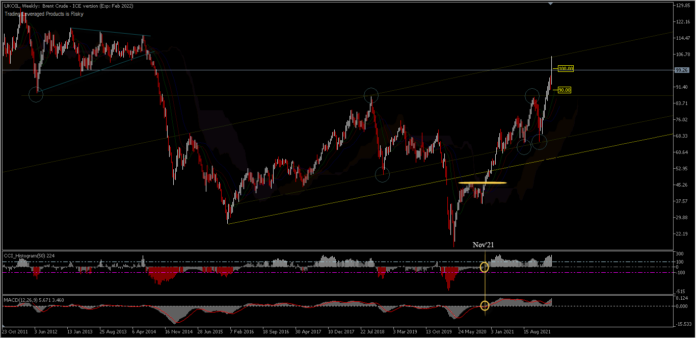

UKOil, Weekly

US President Biden and his allies’ new sanctions against Russia became a turning point for most currencies and stock markets yesterday, though the risk-off mode has turned neutral for the time being. The Pound and the risk sensitive Euro plunged over 250 pips, hitting daily lows, although the daily close recovered some of the losses.

However, gas prices proved to be far more sensitive and recorded huge increases. Russia’s ongoing invasion of Ukraine adds to the concerns of market participants about world gas supplies, especially in Europe, which relies on Russian natural gas. Energy imports to the EU from Russia as a share of total imports to the EU from Russia decreased by 5.9 percentage points (pp) from 61.6% in 2017 to 55.7% in 2020 but increased sharply to 65.5% in the first quarter of 2021. Hence if the supply is eroded, it is not impossible that the energy crisis could hit harder.

According to BP Statistics Review, Russia has a 25.3% share of the world’s natural gas export market, which means it has enough power to move the price of natural gas. In addition, Russia is the second largest natural gas producer in the world with a contribution of 16.6% of natural gas production in 2020.

In addition, Petroleum prices could also be further affected by increased concerns and a prolonged invasion, although some countries have decided to use up their oil reserves. Brent crude futures are holding at $100 a barrel at the time of writing following a dramatic session that saw the British benchmark hit $105 before giving up gains.

Oil previously pared most of its gains, as US president Joe Biden rolled out new sanctions against Russia but made it clear that Western powers are unwilling to sacrifice their own economies to punish Moscow. Biden also addressed the issue of energy supply, saying the US would work with other major consuming nations on a coordinated release of reserves. Japan and Australia have indicated they may be part of an international reserve release, but China has said it has no immediate plans to intervene in the oil market. Meanwhile, US crude stockpiles continued to fall, nearing critical levels that could spur further oil gains.

Technical View

UKOil maintains the 10-week gain that began in December 2021. Technically, the weekly chart has confirmed the inverted head and shoulder pattern since breaking the $86.66 structural resistance in January. The price cycle is also clearly depicted on the CCI (50) and MACD indicators, from when the midline crossing occurred in November. For some time to come, it is believed that the price of this asset will experience high volatility. Temporary resistance is the peak formed yesterday (Thursday) at $105.74 and it is likely that investors will tend to pay attention to political developments in Northern Europe, so that the $100.00 price level will still be the general benchmark. At the bottom support comes from $92.52.

Alongside fears that a break of the $105.74 resistance to $115.00 and $130.00 could trigger an energy crisis, especially in Europe, there is also hope that oil-producing countries that are members of OPEC will intervene in price spikes by increasing their production even more if Russia cuts its oil exports. However, this looks unlikely as a number of officials from OPEC member countries have stated that there is no urgent need to increase production even higher, even though Brent has penetrated the level of US $100.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.