Risk Off mood returned as stock markets dived and safe havens from the USD to US Treasuries rallied. Oil & GOLD markets surged, Brent hit $110/barrel & Gold hit $1950/ounce. More Western companies (Apple, Ford & Boeing,) pull investments from Russia & US banned Russian airlines from its airspace. However, Russian Oil, Gas & Uranium exports all remain open. Asian markets moved lower (Nikkei -1.3%). Biden SOU speech warns “we are coming fro your ill-gotten gains” and off-script says that Putin “has no idea what’s coming”

Overnight – AUD GDP missed (3.4% vs 3.5%), JPY Capital Spending was higher and UK House Price Inflation jumped to 1.7% form 0.6%.

- USD (USDIndex 97.60). Rallied through 97.00 most of yesterday. 97.75 next resistance.

- US Yields 10-yr lower again closed at 1.73, 3 ticks lower to 1.707% now.

- Equities – USA500 -67pts (-1.55%) 4306. US500 FUTS down at 4288 now.

- USOil – Rallied from support at $94.00, yesterday, up to $107.55 now.

- Gold – Rallied from $1905 now, trades at $1948.

- Bitcoin rallied over key 40 & 42K levels to trade at $43,800.

- FX markets – EURUSD back under 1.1100, USDJPY holds 115.15 and Cable down to 1.3280 now.

European Open – The March 10-year Bund future is up 36 ticks at 170.66, while U.S. futures are slightly lower. , although in cash markets the U.S. 10-year rate is down -2.0 bp at 1.707%. Investors are pricing out excessive rate hike bets and in the Eurozone the 10-year Bund yield closed at -0.80% yesterday, with negative rates not expected to go away any time soon. For today, investors are likely to remain extremely nervous, although the -0.7% decline in the DAX future looks modest compared to yesterday’s correction and the FTSE 100 future is actually up 0.1%.

Today – German Unemployment, EZ CPI, US ADP, BoC Policy Announcement, OPEC+, Ukraine-Russia Meeting (Time TBC), Speeches from Fed’s Powell, Bullard & Evans, ECB’s Lane, Schnabel, de Guindos & Nagel.

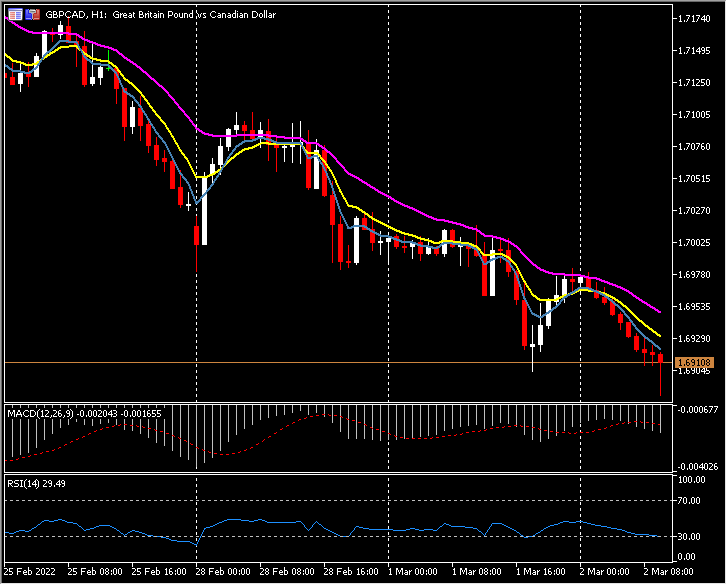

Biggest FX Mover @ (07:30 GMT) GBPCAD (-0.36%) 6-day collapse from 1.7345 continues down to 1.6915 now. MAs aligned lower, MACD signal line & histogram below 0 line, RSI 30 & falling, OB zone, H1 ATR 0.139, Daily ATR 0.9450.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.