Fed Chair Powell said on Wednesday that with inflation well above 2% and a strong labor market, it would be appropriate to raise the target range for the federal funds rate at its meeting later this month. The central bank expects inflation to peak, then decline throughout the year. Taking into account the global uncertainty, the US central bank will continue its policy with extreme caution. Meanwhile, Bullard called for a quick withdrawal of policy accommodation and stressed that the Fed should follow through with rate hikes and balance sheet runoff.

On Wednesday, the US dollar index fell back -0.02% and posted moderate losses after briefly printing a fresh high of 97.82. Notwithstanding, the US February ADP Jobs Change was up +475k, indicating a stronger than expected +375k labor market. ADP January jobs was revised up to show a +509k gain from the previously reported -301k decline. The Dollar gave up gains on Wednesday, after Fed Chair Powell said he favored a 25 bps rate hike later this month, dashing speculation for a 50 bp hike. The Dollar remains lower, after S&P500 gained +1.86% which reduced liquidity demand for the Dollar.

US stocks edged higher Wednesday, as the labor market tends to look stronger after the February ADP jobs change report rose more than expected. Investors continue to monitor the situation in Europe and the impact of sanctions on Russia and the global economy. USA500 gained +1.51%, USA30 was up +1.79% and USA100 was up +1.45%.

Technical Analysis

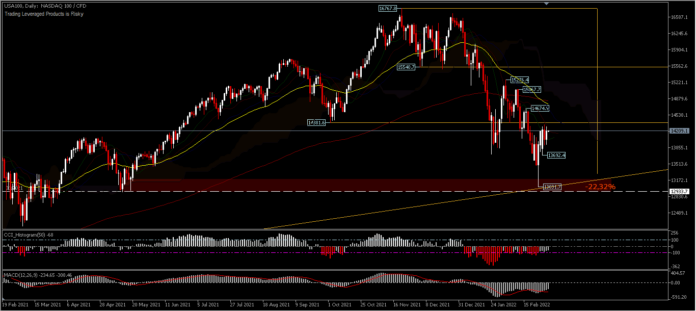

USA100 has posted a significant decline of -22.32% since November last year. The decline has pared all of May 2021’s gains. In the last 5 trading days, the price managed to rebound from a fresh low of 13,031 and managed to recover losses with an increase of +9.09%. A move to the upside will target 14,674, if the asset manages to move beyond the minor resistance of 14,333. The move to the upside will be hindered by the 50-day moving average which has crossed the 200-day moving average near the 14,674 resistance level. The divergence bias on the oscillator is clearly visible, but caution is also evident. A move to the downside will test the minor support at 13,692 first, and a break of this level will only reinforce the lingering concerns.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.