Recent news of economic sanctions towards Russia following its invasion on Ukraine have led to prices of a list of goods being skyrocketed, one of them is the nickel. As Russia is the world’s third biggest producer (over 9%) and also the leading global exporter of nickel, worries over supply shock has led to short-squeeze in the market triggering the commodity price in LME to rose to an 11-year high last week, to over $100,000/ton, nearly double the peak seen in 2007.

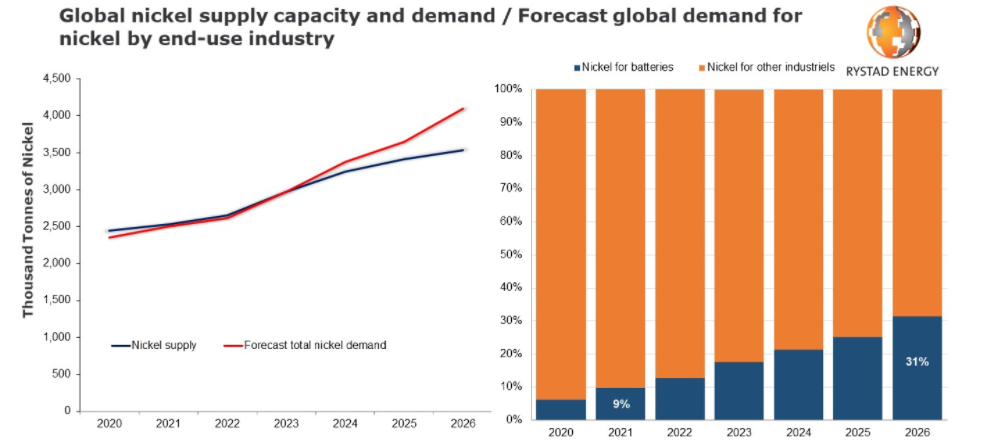

Fig.1: Forecast on Global Nickel Demand vs Supply. Source: Rystad Energy.

As nickel is used in stainless steel and electric-vehicle batteries, sanction towards Russian mining companies may encourage investors to seek for other similar alternatives out of the country. One of the companies which have been benefited by the event is the Anglo-Swiss company Glencore, which comes in 3rd place in terms of production, after Vale (2nd place, based in Brazil) and Nornickel (1st place, based in Russia). Based on Rystad Energy’s forecast, global nickel demand may possibly increase to 3.4 million tones and outweighing supply by 2024, this may serve as another positive catalyst for the company.

In addition, Glencore is also one of the world’s leading producers of other metals such as copper, cobalt, zinc, and ferroalloys. Therefore, despite the fact that Glencore announced leaving its operational footprint in Russia, the impact on the company should be minimal as commodities price is generally still riding on a bullish trend, serving as a tailwind for its business development.

Technical View:

#Glencore share price has been riding on a strong bullish trend since its rebound from the lowest point in March 2020, £1.049. As of its close on last Friday, nearly 390% gains have been accumulated. Based on FE calculation, the nearest resistance level to watch is £5.27, followed by £5.60 and £5.97. On the other hand, psychological level £5.00 serves as the nearest support, while £4.64 and £4.05 will be the second and the third support level.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.