PepsiCo, Inc. is one of the largest companies operating in the beverage and snack market. The company is included in the S&P 500 index, which brings together the largest publicly traded companies in the United States. On March 30, 2022, the company’s capitalization exceeded $229 billion. Pepsi Co. employs over 309,000 employees and sells its products in more than 200 countries and regions, with beverages and snacks its two main product groups.

In its financial statements, the company divides its activities into seven segments: LNA (Frito-Lay North America); QFNA (Quaker Foods North America); PBNA (PepsiCo Beverages North America); LatAm (Latin America); Europe; AMESA (Africa, Middle East, South Asia) and APAC (Asia Pacific, Australia, New Zealand, China).

Historically, the company generated about 45% of its annual sales from beverages, a proportion which has not changed over the last three years under review in this article. Beverages account for about 10% of revenue in the Latin American market, 20% of all sales in the APAC market, and 30% in the AMESA segment. Outside of North America, only the European market generates more revenue from beverages than snacks (55%-45%).

Despite having a strong consumer brand, the company’s operating margins are systematically falling. Between 2017 and 2021, it fell by almost 2 percentage points. The possibility of higher inflation in the coming years could create a difficult environment for companies, and in a scenario where all costs cannot be passed on to the customer, the operating margin will decrease even further. The current margin level is at the average level from 2012-2013. The company still has a very stable business making decent profits, and it should be noted that the company effectively allocates its own capital, with Pepsi’s ROE never having fallen below 40% in the period under review. What’s more, the return on assets is also decent and in 2021 it will be 8.2%.

PepsiCo Inc. revenue in the fourth quarter of 2021 reached $25.25 billion, a 12.4% increase on revenue for the same quarter in 2020. For the full year, the beverage and snack giant’s revenue was $79.5 billion, or 12.9% higher than revenue in 2020, with fourth quarter profit of $1.32 billion. On a per-share basis, the NY-based company reported net income of $0.95. Adjusted earnings for non-recurring expenses and restructuring costs were $1.53 per share.

For 2022, PepsiCo expects to deliver 6% organic revenue growth, which is the upper end of its long-term target range and implies a strong acceleration in organic revenue growth on a two-year basis. In addition, the company expects to deliver 8% constant core currency earnings per share growth.

In recent news, Beyond Meat Inc. and PepsiCo Inc. announced the debut of Beyond Meat Jerky. The practical, plant-based jerky is the first product of the two companies’ joint venture, Planet Partnership, LLC. Launched in stores across the country starting in March, Beyond Meat Jerky offers an on-the-go snack that advances Beyond Meat and PepsiCo’s passion for creating better products for people and the planet.

Technical Analysis

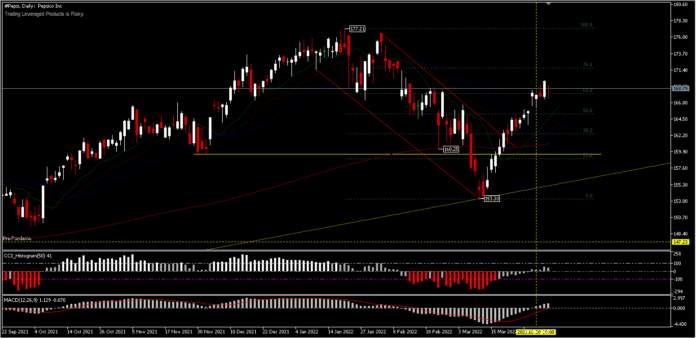

Based on TipRanks forecasts from 13 Wall Street analysts who offered 12-month price targets for PepsiCo in the last 3 months, the average price target is $178.54 with a forecast high of $198.00 and a forecast low of $164.00. The average price target represents a 5.75% change from the last price of $168.84. The current #Pepsi price has recovered from the decline in January 2022, since March rebounded at a base price of $153.33 even as the price is currently above the 61.8% FR level and trading around $168.79. A move to the upside would retarget the $177.21 yearly top. On the downside, support at the $160.00 price range would serve as a barrier in addition to the key $153.33 support.

Based on TipRanks forecasts from 13 Wall Street analysts who offered 12-month price targets for PepsiCo in the last 3 months, the average price target is $178.54 with a forecast high of $198.00 and a forecast low of $164.00. The average price target represents a 5.75% change from the last price of $168.84. The current #Pepsi price has recovered from the decline in January 2022, since March rebounded at a base price of $153.33 even as the price is currently above the 61.8% FR level and trading around $168.79. A move to the upside would retarget the $177.21 yearly top. On the downside, support at the $160.00 price range would serve as a barrier in addition to the key $153.33 support.

From the technical point of view, the daily price position is above the 200-day EMA with the Alligator indicator rising, while the positive sentiment is seen from the 2 oscillation indicators which are in the green zone. For long-term trends, asset prices tend to be bullish.

Click here to access our Economic Calendar

Ady Phangestu

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.