Yields lost their bid, USD held onto gains, Stocks were lifted by the hot US CPI headline data, (new 40-yr high at 8.5%) only to close the day in the red as the CORE figure missed and suggested the top for inflation may be coming sooner than expected. JPY (weak data) & EUR (Putin saying talks at “dead-end”). NZD jumped as RBNZ raised rates by 50bp (largest in 22-yrs). Oil recovered $100, Gold moved higher again.

- Stocks closed marginally lower after strong start. Asia markets stronger (Nikkei +1.68%) & UK & European FUTS marginally higher

- Yields rally cooled, 10-yr from top at 2.836% to close at 2.727% & now at 2.738%.

- EUR fell again after Putin comments.

- USD holds bid, NZD broke 0.6900 briefly as RBNZ said they were not changing their outlook, but just bringing forward rate hike cycle.

- Oil continued to recover and holds over $100 – Shanghai lockdowns ease further but record levels of new COVID infections nationwide.

Biden said Russia has committed Genocide, (additional $750m military aid to Ukraine to come) Putin said Russia will achieve its aims in Ukraine and that talks “have again returned to a dead-end situation for us”. Johnson & Sunak refuse to resign after being fined by the London Met. Police for breaking lockdown rules. More fines to come potentially. Brainard, (Fed Vice Chair), Birkin & Bullard all agreed that aggressive rate hikes were required but disagree what happens afterwards. Brainard sees weaker inflation and a return to pre-pandemic conditions, Birkin & Bullard see inflation, particularly wage inflation, being “sticky” for much longer.

Overnight – JPY Machine Orders & Money Supply miss significantly (-9.8% vs.-1.5%). China Trade Balance (surplus) more than doubles, Exports beat, Imports surprisingly fall. UK Inflation at 30-yr high CPI, (7.0%) CORE (5.7%) RPI (9.0%) & PPI 19.2% – all stronger than expected.

- USDIndex rallied to test new high 100.42 , trades at 100.34 now.

- US Yields 10-yr closed lower at 2.727%, up again now to 2.824%.

- Equities – USA500 -15.08 (-0.34%) at 4397. (A breach of 4400) – US500 FUTS 4418. TWTR (-5.38%) – Earnings Season kicks off today.

- USOil – Trades at $100.30 following a rally to $102.00, Shanghai eases some lockdowns.

- Gold – held $1950 yesterday and tested next resistance at $1975, back to $1970 now.

- Bitcoin continued to decline from key 45k to test 39k zone, recovered to 40k now.

- FX markets – EURUSD back to test 1.0810 earlier, (5-wk lows) now 1.0830. USDJPY breaks 126.00 to trade at 126.15 and Cable sinks back to test 1.2985 as USD bid continues and very hot inflation data weighs.

European Open – Asian stock markets mostly managed gains as markets digested US inflation data that weren’t quite as bad as feared, especially in the core reading. Mainland China bourses struggled though, as hope of easing virus restrictions faded and after trade data showed unexpected weakness in imports, which left the trade surplus higher than anticipated, but added to concern that the domestic economy is struggling with the official “No-Covid” policy. The CSI 300 is currently down -0.3%, the Hang Seng up 0.6%, however, with tech stocks recovering.

Today – US PPI, New Zealand Manufacturing PMI, BoC Policy Announcement, IEA OMR, Earnings from BlackRock, Delta Air Lines, JPMorgan.

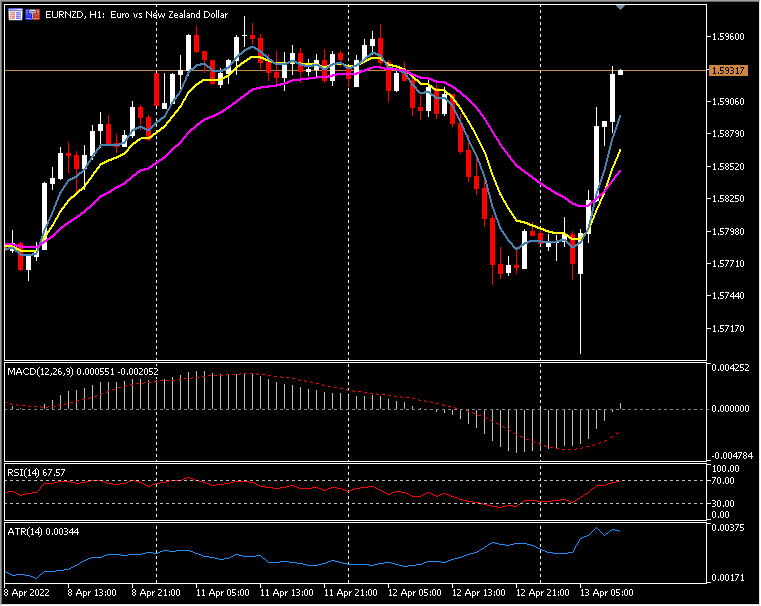

Biggest FX Mover @ (07:30 GMT) EURNZD (+0.77%) Dipped to 1.5700 on RBNZ announcement, reversed quickly to test 1.5935 now. Next resistance 1.5970 & 1.6000. MAs aligned higher, MACD signal line & histogram moving higher & over 0, RSI 68 & rising, H1 ATR 0.00357, Daily ATR 0.01640.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.