Concern over aggressive tightening moves has resurfaced and Australia’s 10-year yield declined, as the short end of the curve was pressured by a jump in headline inflation which lifted to 5.1% y/y in Q1 – the highest level since the introduction of the Goods and Services Tax in the early 2000s. Stocks not surprisingly struggled, although mainland China bourses finally bounced back. Gold was back in demand temporarily and Oil prices backed up, with USOIL at $102.46 now. The Yen sold off, while the USDIndex is moving further above the 102 level. Russia halts gas supplies to Poland and Bulgaria.

- The 10-year Treasury yield is up 4.4 bp, with the curve flattening as the short end underperformed.

- Stocks – Nikkei and ASX meanwhile corrected -1.2% and -0.8% respectively with tech stocks under pressure after the weaker close on Wall Street yesterday. USA100 cratered -3.95%. The USA500 dropped -2.81% and the USA30 sunk -2.38%. GER40 and UK100 are slightly higher at the moment, but underperforming versus US futures.

- Earnings have been mixed but the advent of the key reports ahead left a very cautious environment. While a lot of reports have been better than expected, Q2 outlooks have been cut while guidance has been uncertain. Alphabet was down about 3%, GE disappointed and was the poster child for the headwinds, revealing supply chains problems, rising costs, and shortages of materials and labour.

- USDIndex remains on bid, at 102.52 highs.

- Oil spiked to 102.96, as Russia, which has been demanding payments for its gas in roubles as sanctions over its invasion of Ukraine bite, said it will halt supplies to Poland and Bulgaria from Wednesday.

- Gold back below $1900.

- FX markets – USDJPY over the 128 mark again, EURUSD extends to 1.0615, GBPUSD steady to the downside at 1.2558, USDCAD to 1.2828 highs.

Today – ECB’s President Lagarde speech, BoC’s Rogers speech, BoC’s Governor Macklem speech.

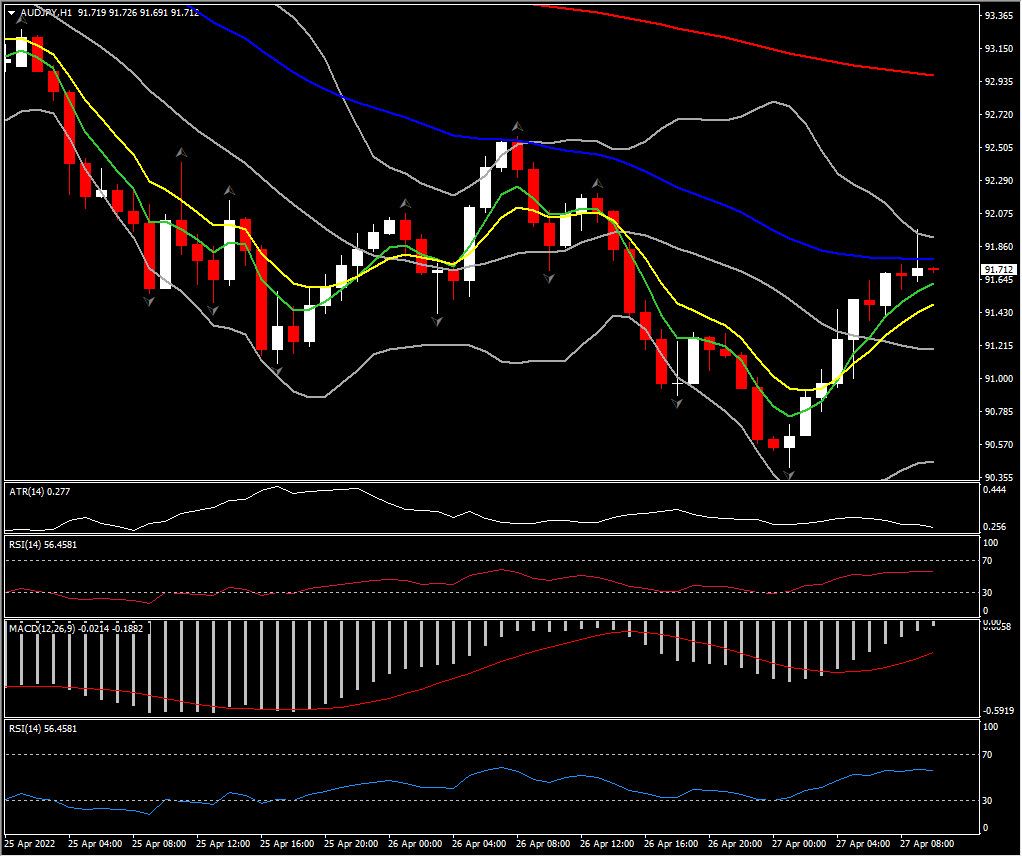

Biggest FX Mover @ (07:30 GMT) AUDJPY (+1.29%) Breached 92. MAs flattened, MACD signal line & histogram moving higher close to neutral zone, RSI at 45, all signalling a pullback. H1 ATR 0.305, Daily ATR 1.195.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.