USD continues sideways ahead of the Fed, Tech Stocks were hit by news that the US began a probe into Didi Global Inc’s 2021 debut in New York. VIX is under 29.00 as a 50 bp hike is fully priced in, with risk of a hawkish outcome. Better than expected factory orders and JOLTS data had no real impact in the market. Yields jumped higher with 10-yr at 2.99%. Aussie and Kiwi got a lift from strong local data this morning – Australian retail sales jumped 1.6% in March, outpacing forecasts for a third straight month. Jobs data in New Zealand were also upbeat with unemployment holding at record lows of 3.2% and wages hitting a 13-year high.

- Equities – USA30 and UAS100 finished 0.20% and 0.22% higher, respectively. UK100 edged higher, as energy shares lifted by upbeat results from oil major BP outweighed a strong sterling and weakness in mining shares. Hang Seng and ASX declined. Alibaba shares fell as much as 9% on worries over the status of its billionaire founder Jack Ma.

- Yields nudged higher – to 2.99% as the FOMC announcement today comes into view. Australia’s yields continued to rise following the RBA’s bolder than anticipated rate hike yesterday.

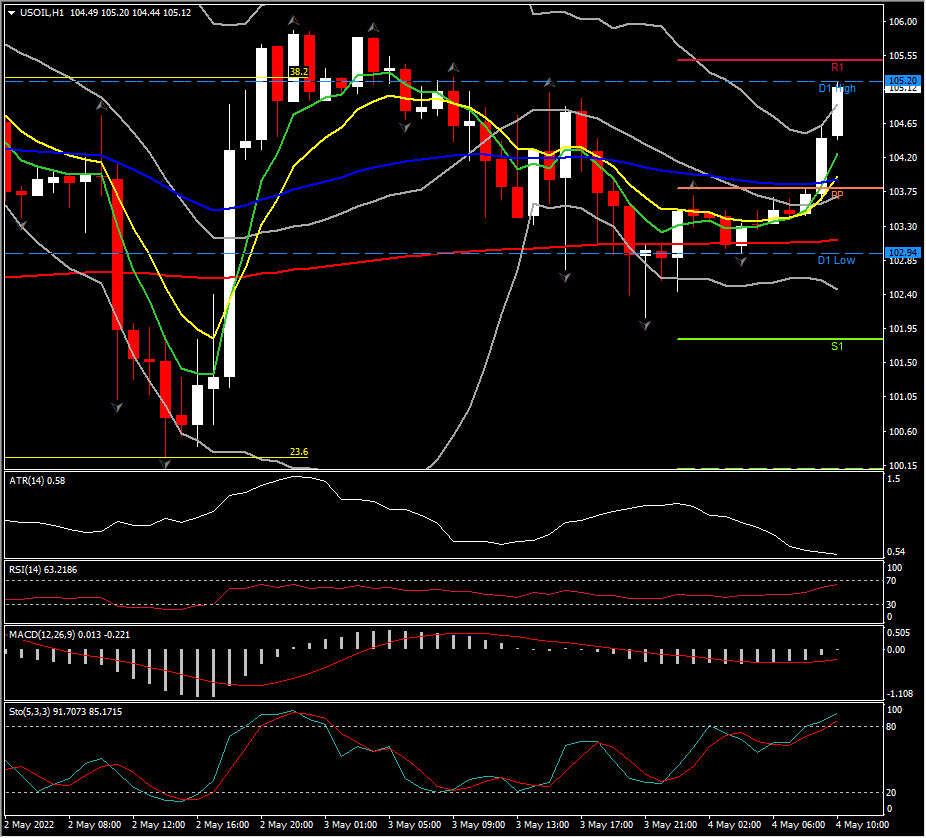

- Oil at 104.20 per barrel, rose slightly after US industry data showed a drawdown in US crude and fuel inventories.

- Gold down to 1864 area, as higher US Treasury yields and a looming interest rate hike announcement by the Federal Reserve dented demand for zero-yield bullion.

- FX markets – EURUSD retests 1.0500 again, USDJPY sideways at 130.00, Cable drifted below 1.2500 at 1.2460. AUD holds at 0.7120.

FOMC announcement due today. A 50 bp hike is fully priced in, with risk of a hawkish outcome. However, it is hard to see the Fed “out-hawking” market expectations in terms of the statement language. The Fed is universally expected to boost the rate by 50 bps, and though there is risk for a 75 bps hike, there have been no strong indications from Fed officials that is forthcoming. And we expect Chair Powell to take a cautious approach in his press conference. We know the FOMC wants to frontload rate increases and Powell indicated the Fed will move “expeditiously” but he will have to be nimble in terms of signaling further rate increases but without specificity in order to maintain flexibility. We expect the Fed will hike another 50 bps in June and then a quarter point boost in July, though it is possible for a 50 bp or 75 bp move, depending on both inflation and growth data and the extent of QT.

Biggest FX Mover @ (06:30 GMT) USOIL (+2.30%) rebounded this morning to 105.20 highs. MAs aligned higher and RSI is at 6, but MACD signal line & histogram hold at zero. H1 ATR 0.54, Daily ATR 4.52.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.