Coffee prices have recently held on amid global demand concerns, including the Chinese government saying it will continue its strict Shanghai-Beijing pandemic lockdown, and the Russia-Ukraine war restricting Brazil’s coffee exports to those countries. In today’s trading, #Coffee recovered from early losses and moved higher as the strengthening of the Brazilian real hampered export sales from Brazilian coffee producers. The real strengthened against the US Dollar, amid declining US Dollar liquidity due to profit taking. Brazil is grappling with persistent shocks that saw consumer prices rise more than 12% in April, the highest level since October 2003.

Coffee prices are starting to lose upward momentum, as the risk of freezing temperatures in Brazil recedes. Forecasters say winds and clouds in Minas Gerais, Brazil’s largest arabica-producing region, are preventing a severe drop in temperatures, thus eliminating the threat of frost damaging crop development.

In mid-April, Brazil’s coffee export board Cecafe reported that Brazil’s March green coffee exports fell by 5.8% y/y. A factor in favor of arabica is the smaller supply of coffee from Colombia, the world’s second largest producer of arabica. The Federation of Colombian Coffee Growers reported earlier in May that Colombian April coffee exports fell by -18% y/y due to lower production. Colombia’s coffee production fell 13% in March, and was down 16% in February.

Meanwhile, concerns about a smaller supply of coffee (robusta) from Vietnam supported coffee prices. The Vietnam Coffee and Cocoa Association warned that high fertilizer prices are likely to force coffee farmers to reduce fertilizer use, which could lead to a 10% drop in next season’s coffee production.

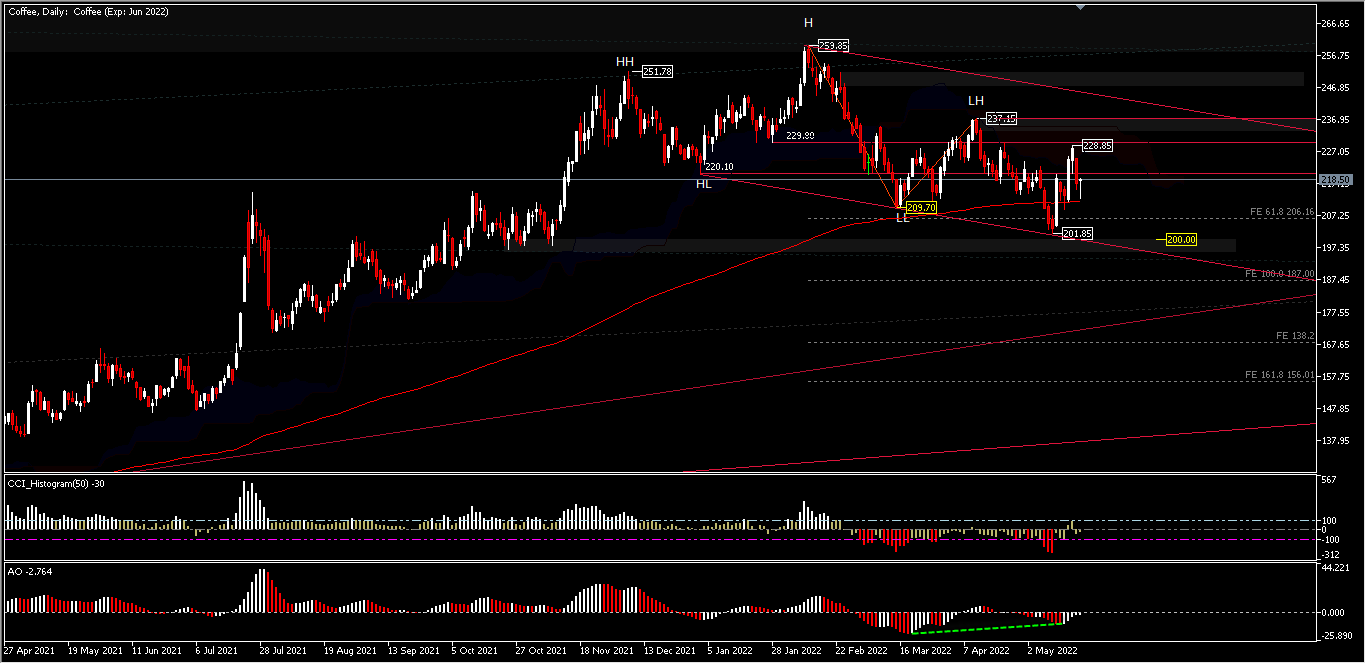

Technical Overview

The price of #Coffee (Exp. June) has held above 200.00 for the last 7 months, though the momentum of the rally seems to be starting to erode, after recording a peak price of 259.89 in February 2022 as the outbreak of war reduced global coffee exports. Even during January to May, the price movement produced bearish waves, which can be seen from the break of the 220.10 and 229.80 bullish wave structures in March and the recording of a new low of 209.70 at that time, before pulling back to 237.15. The decline from the 2nd peak in April even surpassed the fresh support of 209.70 by recording a lower low (LL) at 201.85 and since then, the price has climbed back to the upside but remains below the 237.15 peak price.

#Coffee, D1

Technically, the price tends to be neutral holding above the 200-day EMA, but limited below the Kumo. A move above 228.85 will test the resistance at 237.15. As long as 237.15 holds, the outlook to the downside is open for a retest of a fresh 201.85 low. And a break of this level will be projected for FE 100% at 187.00 (from drawdowns of 259.89-209.70 and 237.15).

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.