Crude oil prices rose to two-month highs earlier in the week as the European Union awaited a possible agreement to boycott oil from Russia, one of six more sanctions packages planned on Moscow. USOil posted fresh peaks in the $119.92 area per barrel before closing lower at $115.16 yesterday.

The European Union will meet for two days to discuss the six new sanctions. If the oil boycott proceeds, the supply shortage in the market will be even tighter amid rising demand for fuels such as gasoline, diesel and airplane fuel due to the holiday season in the United States and Europe.

The European Union members have not yet reached an agreement on an embargo on Russia’s oil, but talks about it are still ongoing. For now, the possibility of an agreement to embargo oil shipments by sea is being discussed, while distribution via land pipelines, such as the Druzhba pipeline that supplies Hungary, Slovakia and Czechia, will continue for some time until alternative supplies can be arranged.

Several members of the Organization of the Petroleum Exporting Countries (OPEC) are considering proposing the removal of Russia from their oil production deals, the WSJ reported on Tuesday. The sources added that some members of the organization are also planning to ramp up their own pumping in the next few months to respond to global needs. The accusations that some members are planning to ramp up production came after the European Union decided to ban 90% of Russian oil imports due to Moscow’s military intervention in Ukraine.

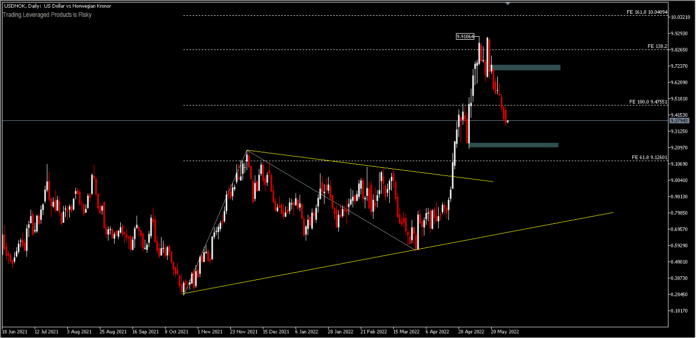

Trading of energy commodity based currencies such as MXN, CAD and NOK have benefited from all the dynamics above in the last month. The CAD has strengthened more than 3% against the USD from 1.3075 fresh peaks this year and returned to its January 2022 opening price around 1.2600. The MXN gained more than 5% against the USD in May and the Norwegian Krona has paid for its May losses by returning to its monthly opening price, slightly up 0.20% against the US Dollar, after drifting from the 9.9125 peak.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.