The Dollar bounces from a monthly low and finds some support amid increased inflation and recession fears.

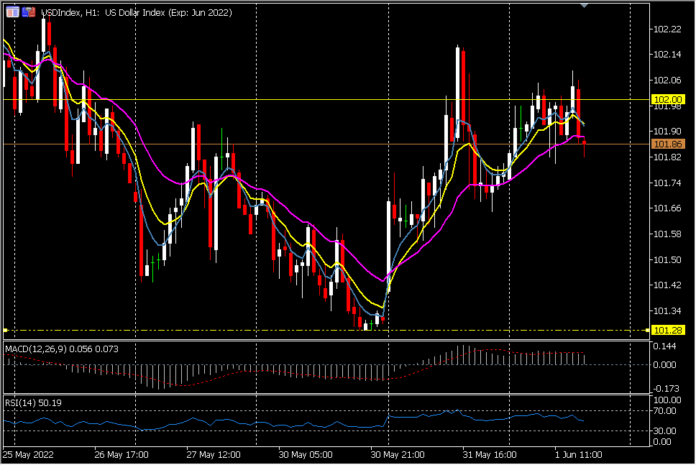

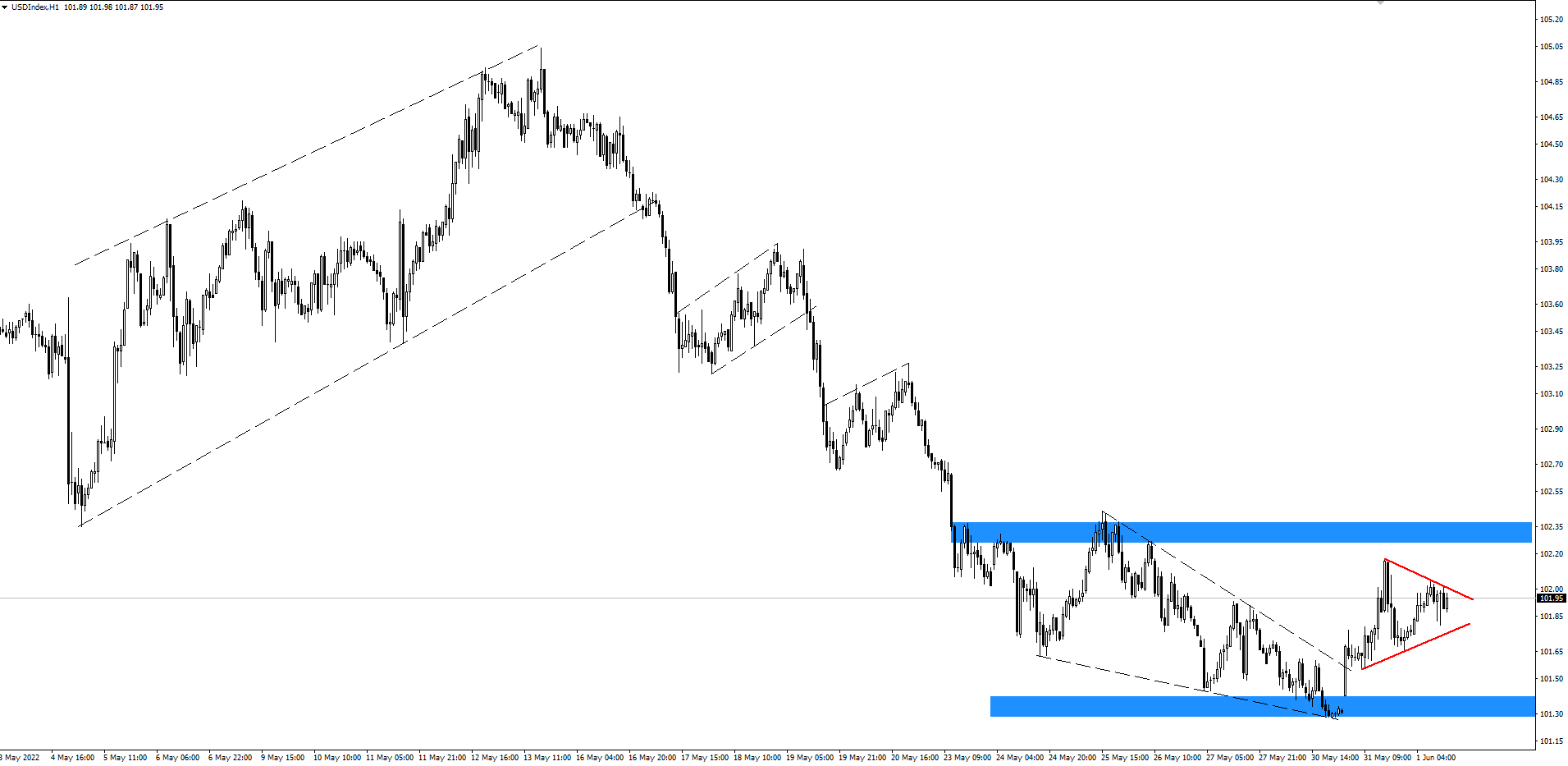

USDIndex, H1

This week sees the Dollar potentially finding some support since pulling back from 20-year highs. The newly found floor around the 101.28 level can be attributed to shifting risk sentiment in the market that’s been largely driven by the ongoing inflation printouts coming from major economies, which are likely to continue to affect the ebb and flow of demand for the safe-haven benefits that come with exposure to the Dollar in times of economic uncertainty.

Technical Analysis

In terms of market structure, the price is approaching the 101.29 area in the form of a falling wedge, which points to the probability of a reversal occurring at these levels of buy sensitivity. The price reacted off the level in an impulsive wave, followed by a bullish flat continuation pattern. The buy-side scenario could see the bulls take control of the market and drive the price towards the 102.43 area as a first target. Conversely, the sell-side scenario could see the bears take control of the market if price breaks below the 101.29 area.

EURUSD, H1

The Euro continued to rally towards the key levels identified last week, and only began to pull back from these zones on Monday during the New York session. This weakness is attributed to the higher-than-expected inflation printouts coming in at 8.1% in May from 7.4% in April, beating expectations of 7.7%, as well as a rise in Treasury Yields.

Technical Analysis

In terms of market structure, a reversal pattern began forming as the price reached the 1.07851 area, and the corrective nature in which this key level was approached indicates a high probability of a reversal forming at these levels. In the bearish scenario, sellers could take control of the market and drive the price towards the 1.05334 area as a first target. Conversely, the bulls could take control of the market if the price breaks above the high that was set earlier this week.

GBPUSD, H4

Despite the ongoing European recession fears, the Pound has still managed to just about hit its biggest monthly gain since the year began versus the Dollar. This buoyancy has largely been driven by strong labour market numbers as well as better than expected CPI data over the past couple of weeks. Some of this exuberance can also be attributed to the FED revising their outlook on future rate hikes, which lead to the dollar pulling back from 20 year highs, further benefiting the Pound.

Technical Analysis

In terms of market structure, the price action is generally locked in a range and is now trading at the highs, triggering sell side liquidity around the 1.26576 area. The way in which it has approached this area has formed a bearish reversal pattern in the form of a rising wedge. The probability of this setup is pointing towards a bearish reversal at these key levels. Conversely, a break above this peak formation, firmly puts buyers in the driving seat, to move price all the way towards the 1.30232 level.

XAUUSD (GOLD), H4

Hawkish Fed talk from Christopher Waller and co, coupled with a firmer Dollar, has dented some of the gains made by gold in the past weeks. Mr Waller reiterated a strong stance in support of more interest rate hikes at the next several Fed meetings scheduled for the year. This development leaves the price of gold in a precarious position, as the likelihood of falling below $1800 per ounce increases with every interest rate hike. This is mainly because rising interest rates make stocks, government bonds and other investments more attractive to investors as opposed to the yellow metal.

Technical Analysis

In terms of market structure, the formation of an ascending channel can be seen and the corrective nature of how price is approaching the key level around the $1871 area is indicative of a potential move to the downside to challenge the lower end of this range around the $1805 area. A confirmation of a break of the structure has happened, which increases the probability of bears taking control of the market. Conversely, a break above the $1871 area in an impulsive wave will potentially open the way for bulls to take control of the market and drive the price to the next psychological level of $1919.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.