USOIL prices are once again being pressured by stagflation concerns, which have sent stocks and yields down during the week. After the Fed’s major interest rate hike last week, USOil prices are down more than 5% this week following Fed Chair Powell’s testimony.

Fed Chair Powell did not really say anything new in his testimony to the Senate Banking Committee in the first leg of his required Monetary Policy Report to Congress. Treasuries were in rally mode all session amid haven demand and as the Chair continued to stress the Fed is “strongly committed” to bringing down inflation and that restoring price stability is “absolutely essential.” The big question is whether the Fed can accomplish this without causing a recession.

Meanwhile, the weaker than expected Eurozone PMI reports added to expectations of a broad downturn in global growth. Recession fears have led to a rally in bonds and the correction in growth expectations is also prompting traders to correct demand expectations for oil, which has capped prices for now. European gas prices meanwhile are rising, with TTF up 7.30% on the day and nearly 10% over the week, amid growing concern that Russia is throttling supplies now in order to prevent countries from filling storage levels ahead of the winter.

Hence in general the uncertainty over the overall economic outlook against the background of aggressive central bank action will likely continue to underpin volatile and jittery market moves. In the longterm however, prices remain far above the levels seen last year as Russia’s invasion of Ukraine and sanctions against Moscow make for tight physical markets. Supply and demand imbalances are likely to keep prices underpinned well into next year although in Europe, concerns over gas shortages are trumping oil price jitters for now, as Russia throttles supply and governments struggle to find alternative suppliers. For now this looks OK, but there is mounting concern that a cold winter could lead to supply shortages in Europe, which would further add to recession risks.

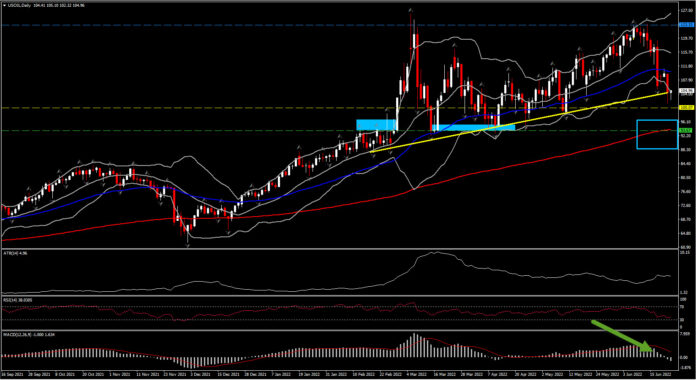

Currently USOIL has extended declines for nearly 10 consecutive days, to the $101.50 area, retesting the 3-month trendline. In the medium term, the sharp decline below 50-day EMA, along with the bearish MACD turn, is raising concerns whether the USOIL outlook has turned negative, indicating more bearish bias in the near term. The RSI is at 38 but flat, backing the bearish outlook in the medium term, but contracting it at the same time for the intraday picture.

Key Support levels for the asset, if it manages to extend declines below the this ascending trendline that has been identified since the beginning of the year, could open the doors to the confluence of the 200-day EMA and year’s support at $93.70-94.00. Further decline from the latter could bring $85.00-$87 into play. To the flipside, the 50-day EMA holds as a key Resistance level for the asset, as a turn of USOIL above the $111.00 area could indicate a breach of the year’s peak again.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.