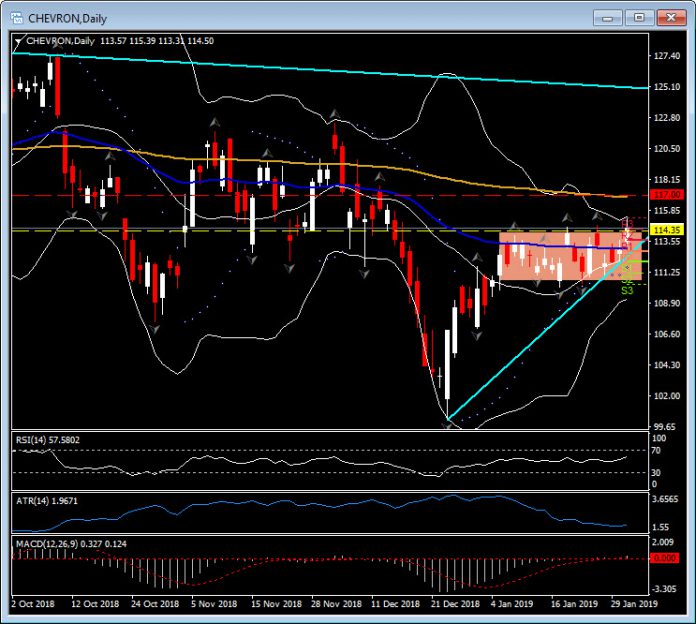

Chevron, Daily

The major Oil companies are in the middle of their reporting season, with Q4 earnings due today (February 1) for both ExxonMobil and Chevron. Yesterday Royal Dutch Shell reported a strong rise in fourth quarter and full-year profits and the share price closed up 3.65%, so expectations are high for the two US giants today.

Seeking Alpha.com reported “Analysts expect the company to report earnings of $1.87 per share on revenue of $46.13 billion. The consensus EPS estimate was lowered from $2.00 in the last seven days. The company has a mixed history of beating and missing EPS estimates over the last year. The company beat estimates in November and April but missed in July and February. In each of these instances, the stock reacted as you would expect – it fell when Chevron missed and moved higher when the company beat.”

Technically, the chart has been consolidating during January, capped at 114.35 and the 61.8 Fibonacci level of the December 2018 move from 122.80 to 100.55. Immediate Support is S1, the 50.0 Fibonacci level and the 20-day Moving Average at 111.50, the bottom of the channel and S3 at 110.24 and the lower Bollinger band at 109.00. Resistance beyond 114.35 is at R3 and the upper Bollinger band at 115.25, the 200-day Moving Average and psychological 117.00 and the December high at 122.80.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.