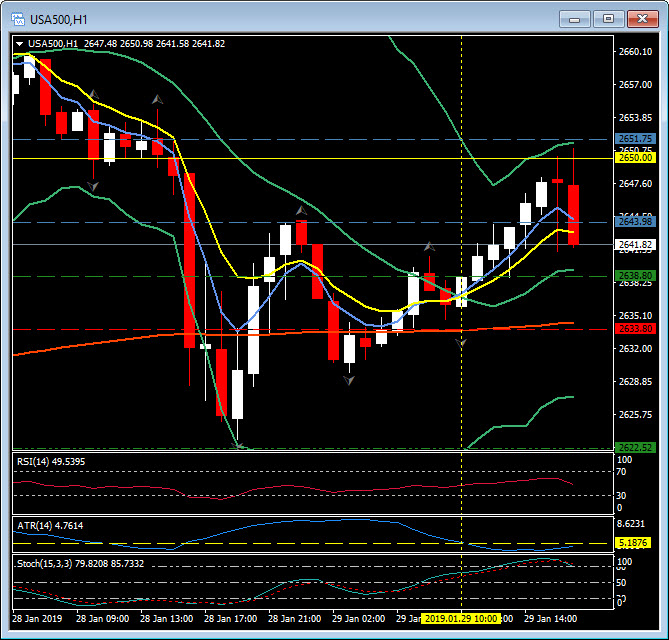

USA500, H1

US consumer confidence has fallen to 120.2 from 126.6 in January, 128.1 in December and a prior 18-year high of 137.9 in October. Expectations were for a slip to 125.00, 120.2 represents a significant miss for this notoriously volatile soft indicator. The Dollar slipped lower following the weaker than expected consumer confidence print. EURUSD topped at 1.1425 from near 1.1415, while USDJPY edged a few points lower to 109.41.

Equities continued to track higher today, with the USA500 touching the key 2650.00 level. Earning results today include:- Harley-Davidson, which posted a -68.5% miss for Earnings Per Share (EPS) that were expected at $0.33 and came in at only $0.17. They also reported that tariffs wiped out all profits. The other big miss today came from SAP with EPS down 32.0%. Better news came from Xerox, which posted an EPS beat of 9.6%, Pfizer a 3.2% beat and Corning with a 20.4% beat. Other positive numbers came from Verizon, 3M and Lockheed Martin.

Earlier, NEC Director Kudlow said in a Fox Business interview that Trump is “moderately optimistic” on a China deal. He also noted it’s possible that we’ll see no impact in the long run from the shutdown (and we note that prior shutdowns have never been clearly identified in the past). Kudlow also said he’s a happy warrior, an optimist, and sees no recession ahead. While profits are not going to rise the 25% seen previously, expectations are for about 10% to 15% growth, while interest rates are historically low.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.