EURUSD and EURGBP

Forex markets have been directionally limited in early week trading so far. The main theme has been modest Yen gains, which has been concurrent with a drop from highs in Asian equity markets, with the initial euphoria over the temporary end to the US government shutdown fading and the focus returning to US-Sino trade risks and Brexit jitters.

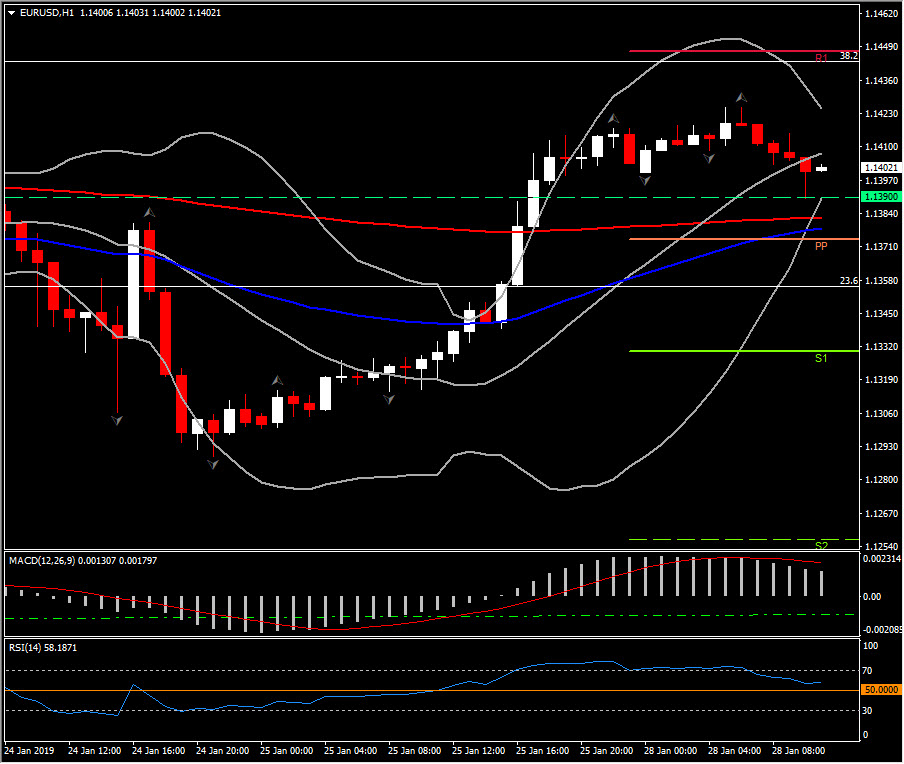

European stock futures are heading south in tandem with US futures. EURUSD has maintained a range of less than 35 pips, a breath below the 1.1400s, as the US Dollar holds a conservative stance ahead the FOMC policy statement and NFP data. EURUSD currently holds a floor at 1.1390 level.

However our main interest turns to Pound, as we are heading into another significant week for the UK.

UK Week: Tomorrow is the Parliamentary vote on the Withdrawal Agreement, mark II, where there will also be votes on various amendment bills, to either extend the Brexit process beyond the official exit date of March 29 or to rule out a no-deal Brexit.

Possible Actions:

- If Prime Minister May win concessions on the Irish backstop, which doesn’t look likely, the vote is set to be blackballed.

- If Parliament also fails to reach a consensus on an alternative way forward, a new referendum would then be the way forward (i.e. a no-deal Brexit off the table).

- A new referendum would also raise the possibility of remaining in the EU.

- At this point, the EU would need to agree on Brexit being delayed.

- In case Brussels do not agree on extending exit date, the UK’s Parliament would likely flex its muscles and revoke Article 50, which the UK can do unilaterally and which would halt the Brexit process.

EURGBP:

As for the market action so far, the EURGBP cross has triggered our attention, as it is holding a 19-month bottom at 0.8615, after the sharp acceleration of Pound seen in the last 4 weeks from 0.91 highs.

January’s end is likely to provide a notable sign for EURGBP’s 2019 performance as the retest of 0.8615 bottom also coincides with the low edge of 14-month range and the lower Bollinger Band pattern in a monthly basis.

Therefore it will be interesting to see whether the asset will be able to break the range!

A decisive break of this range could raise hopes for an increase of the bearish bias and would suggest the retest of the 0.8300-0.8450 area. Immediate Support is set at 200-week EMA, at 0.8550.

The momentum indicators in both the short-term and long-term picture are negative, despite today’s buying pressure and rebound up to 0.8670. Daily RSI retests oversold barrier, while the MACD oscillator suggests an increasing negative sentiment as it extends its lines southwards below signal line.

Nevertheless, an upside swing could find immediate Resistance at the November’s Support and 23.6% retracement on January’s price action, at 0.8695-0.8735 area. A failure to move above this hurdle could be a selling opportunity in the near future.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.