As mentioned before, interest rates are quite important in FX markets. Although investors use interest rates in a variety of ways, the most notable is the carry trade.

As discussed, the carry trade uses the interest rate differential between two currencies (countries) in order to earn interest on the trade. Information on the differential (spread) between two currencies is located on our website, where the precise rates used on each trade can be found.

Nonetheless, for the majority of traders, the precise interest rate differential is not usually a consideration when they enter or exit a position, even though knowledge of whether it is positive or negative can be important. To this end, this post offers an overview of the interest rate differential between the major currency pairs, in order for traders to keep in mind whether allowing their position to go overnight would result in a loss or a profit.

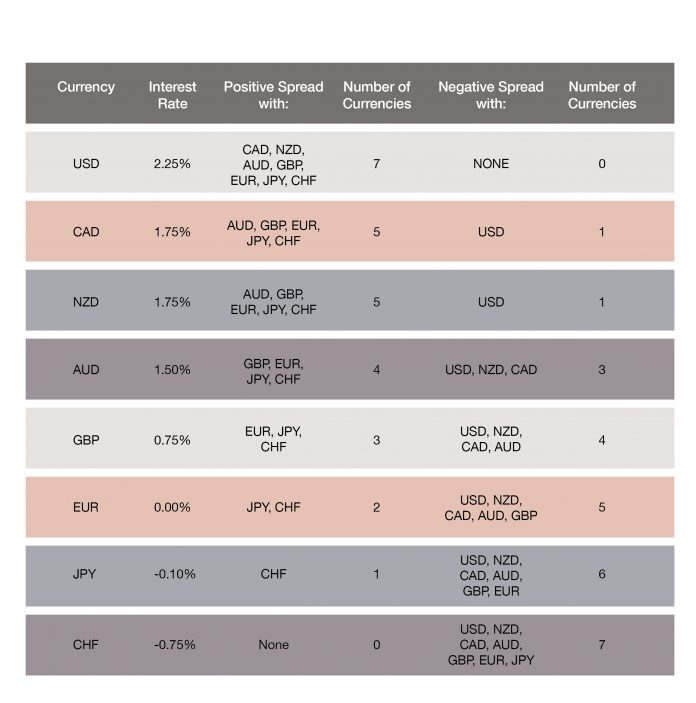

The table above presents an overview of the main currency pairs and their interest rates. As can be observed, the US Dollar currently has the highest interest rate, at 2.25%, and thus has a positive interest rate differential with all 7 of the other currencies. As such, any trade where the USD is bought will result in a positive swap rate, if the position is held open overnight.

On the opposite end of the spectrum, the Swissy has a negative spread with every other currency suggesting that a trader can expect negative swap rates if he/she goes long on it. On the other hand, if someone shorts the CHF they can expect a positive swap if the position is held overnight. In contrast, going long on the Sterling will register a positive swap rates against the Euro, Yen and Swissy, while it would result in negative spread (swap) for the US Dollar, Kiwi, Loonie, and Aussie.

Naturally, a positive or a negative swap does not mean that the trade will be either successful or unsuccessful. What it simply suggests is that a trader can expect to earn (or lose) more or less depending on the interest rate spread between two currencies. In addition, given that interest rates do not change that often, a trader can use this table for future reference when it comes to trading the majors.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.