There hasn’t been a strong theme in the forex markets so far today. European stock markets have mostly declined, as risk aversion picked up in Europe. Investors still found some positives in the Chinese GDP numbers, which slowed as expected but also showed signs of stabilisation in some areas.

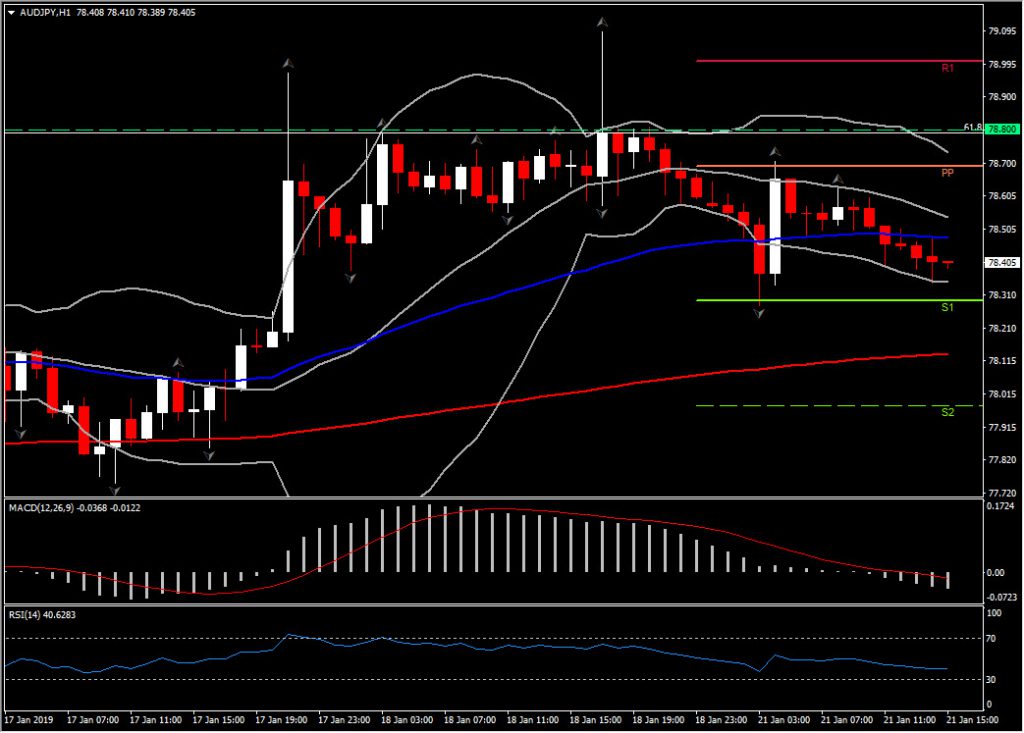

Meanwhile, USDJPY is trading moderately softer, though has held within Friday’s range so far. An intraday low was printed at 109.47. AUDJPY saw a similar decline, but also remained within its range seen on Friday. It is currently trading at 78.50.

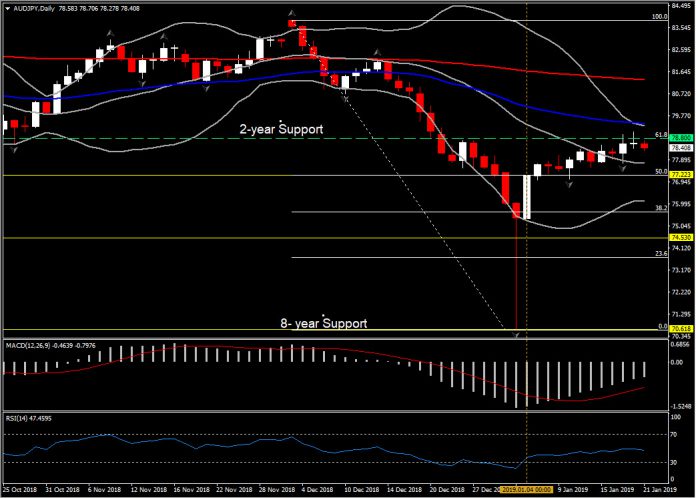

As the Yen weakens amid a risk-back-on theme in global markets, AUDJPY remains for the 3rd consecutive day near the key level at 79.00, recouping nearly 60% of December’s losses so far . The overall weakness of the Aussie does not seem to have faded yet, proven by the fact that the asset is below 2-year Support, which has now been converted to Resistance, at 78.50-78.80 area.

However, January has proven beneficiary for the asset, hence in the near future, a break of this strong barrier could attract more bulls, which could lift the asset back into the 81 zone. Oppositely, a crossing below 77.20 level should turn the outlook into a negative one, as this level presents the move below 20-day SMA, latest low fractal and the 50% Fibonacci retracement level.

Daily momentum indicators are mixed, as RSI is struggling to cross above 50 , while MACD continues to accelerate higher. This picture implies poor positive momentum leading to a consolidation in the daily time frame. Intraday Support and Resistance are at 77.20 and 78.70 respectively.

From the fundamental perspective, expectations for the US and China to be more committed to finding resolution to their trade dispute, becomes increasingly evident on both sides of the Pacific. This could burst Yen further.

Click here to access the HotForex Economic calendar.

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.