USDCAD and USOIL

Oil broke the key $50 level and is currently challenging the R1 from Pivot Point analysis at 50.37. Hopes for a solution to the US-China trade impasse, along with OPEC+ production cuts, which are beginning to make a mark on supply levels, have been the drivers this week.

Daily momentum indicators indicate that there are some bulls that could keep the price action northwards in the near future, with long-term bias remaining negative as the asset has not yet managed to reverse more than 23.6% of its 3-month tumble.

MACD lines crossed above signal line amid fresh positive momentum on USOil, suggesting weakness from bears. RSI strongly supports the possible reversal of this long downtrend, confirming the positive divergence seen between November 13 and December 26.

In the long term, the sustainment of the negative outlook on USOil holds, as it remains below 50% fib. retracement level from the 2-year rally and the round $52.00 barrier, which coincides with R3 for the day.

Even if in the bigger picture the market continues to hold in bearish tendency, a decisive close above the latter could boost Oil towards $54.55-$55.60 area. A rejection of 52.00 handle could shift price to 20-day SMA at $48.00. Below that, the $45.50 could provide support (61.8% fib level in 2-year rally).

Meanwhile today, after the break of $50 level and as the pair remains above it, the next intraday Resistance to watch is at $50.97-$51.00 (R2 and upper Bollinger Band barrier). Immediate Support is at $49.95 (200 SMA in the 4-hour chart and yesterday’s peak)

In conclusion, oil futures currently continue to have with an overall bearish outlook, while in the short term it is in a bullish mode, with indications for a possible reversal on the 3-month decline.

So far today, Greenback has posted fresh lows against the Canadian and Australian Dollars, which have outperformed amid a backdrop of firmer crude and global equity markets while still holding below recent lows versus other currencies.

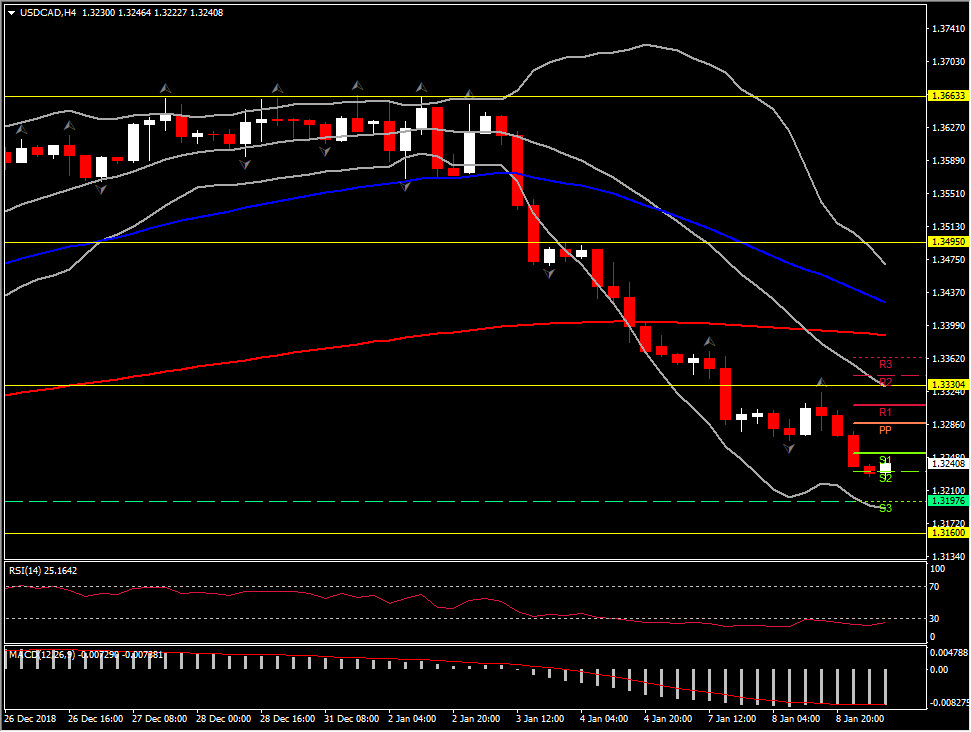

USDCAD, now in its sixth consecutive session of decline, concomitant with a series of higher rebound highs in oil prices, printed a 5-week low at 1.3226. USDCAD’s early December low at 1.3160 provides a downside waypoint, while intraday Support comes at 1.3197.

BoC policymakers meet on policy today, where no change is forecast to the current 1.75% setting for the policy interest rate amid a slowing economy, moderating inflation pressures and the hefty downside risk posed by weak oil prices to real sector growth. (See our BoC assessment)

The drop-off in oil price (despite the pick-up this year) is more than sufficient to keep the BoC on the sidelines at the January and March announcements. However hawkish comments today, suggesting hiking in the upcoming future, could extend the Canadian Dollar’s gains.

Click here to access the HotForex Economic calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.