FX News Today

- 10-year Treasury yields are down -0.2 bp at 2.753%, JGB yields fell back -0.3 bp to 0.019%, and 10-year Bund yields are down -2.2 bp at 0.214% in early trade, with yield curves flattening after the Fed’s decision to go ahead with the rate hike.

- Topix and Nikkei still lost -2.51% and -2.84% respectively. The Hang Seng is down -1.26%, the CSI 3090 down -0.91% and the ASX -1.34%. US and European futures are also firmly in the red.

- Oil prices remained under pressure and February WTI is up from yesterday’s lows at USD 47.17 per barrel.

- Markets clearly take a much more pessimistic view on the global economic outlook than central banks and the stock sell-off that started after the Fed disappointed markets and wasn’t as dovish as markets had hoped deepened during the Asian session.

- The better than expected data out of Japan, where the All Industry Index improved 1.9% m/m was overlooked.

- BoJ left rates on hold and also sounded cautious, but with the Yen strengthening,

- Today, US futures gain following a mixed session for equities in Asia overnight.

Charts of the Day

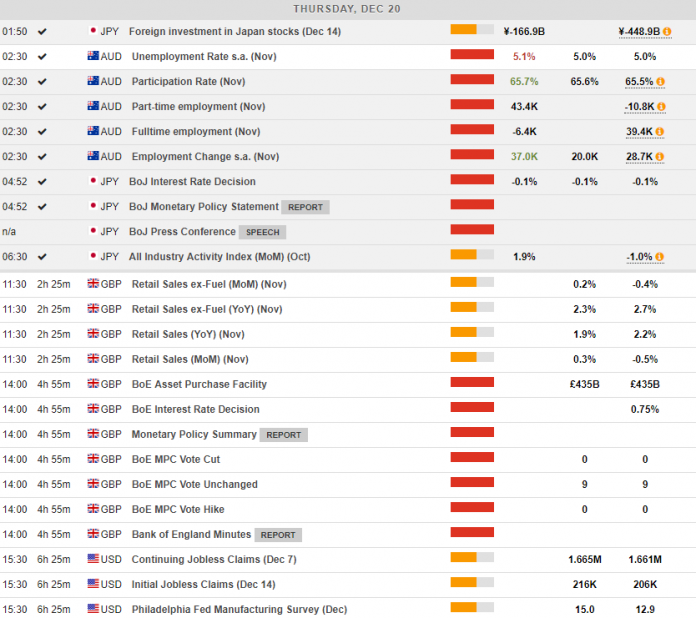

Main Macro Events Today

- UK Retail Sales – Retail Sales for November are expected to have declined to 2.3% y/y, compared to 2.7% in October, in view of increased uncertainty regarding Brexit.

- BoE Interest Rate Decision – BoE is not expected to make any interest rate changes as it is constrained by the overall Brexit progress and thus the interest rate is expected to remain at 0.75%.

- Jobless Claims and Philly Fed – Jobless Claims, both initial and continuing, are expected to register an increase this week, adding to worries about the US’s macroeconomic outlook. However, the Philly Fed index is expected to increase thus providing a mixed picture of the overall US economy.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.