FX News Today

- In Asia, long yields dipped in tandem with Treasury yields, with the 10-year Treasury yields are down -0.2 bp at 2.816%.

- Asian and European stock futures are mixed with all eyes on the Fed, with UK100 futures heading south, while GER30 futures are marginally higher. Topix and Nikkei are down -0.41% and -0.60%

- Oil prices fell to a low of just $46.10 before regaining some ground to now USD 46.50 per barrel.

- US budget update: Democrats rejected the bill offered by Senate Leader McConnell. Avoiding a government shutdown with a short-term spending bill before the holidays seems the most sensible solution, but this is the first major power play since the mid-term elections, which saw the House flip to the Democrats starting next year.

- Today, US futures gain following a mixed session for equities in Asia overnight.

- German producer price inflation came in higher than anticipated at 3.3% y/y.

Charts of the Day

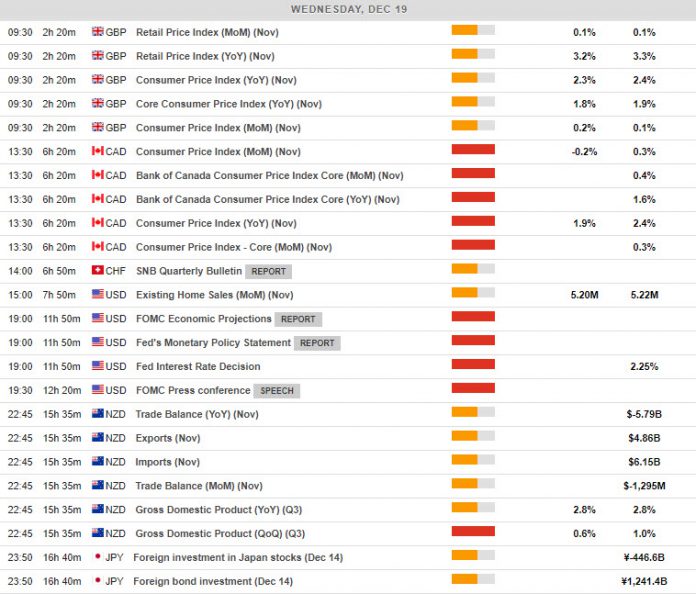

Main Macro Events Today

- UK CPI – Expectations – The headline CPI is expected to ebb to 2.3% from 2.4%.

- BoC CPI and Core – Expectations – CPI is seen falling 0.4% m/m (nsa) in November after the 0.3% gain in October, as a 10% plunge in gasoline prices pulls the CPI lower relative to October. The CPI is seen slowing to a 1.8% y/y pace in November from the 2.4% clip in October, with gasoline prices again being the driver.

- FOMC Monetary policy and Conference – Expectations – A 25 bp tightening in the Fed funds rate is priced in. What will be key is what’s indicated about the 2019 rate trajectory.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.