EURUSD, H1

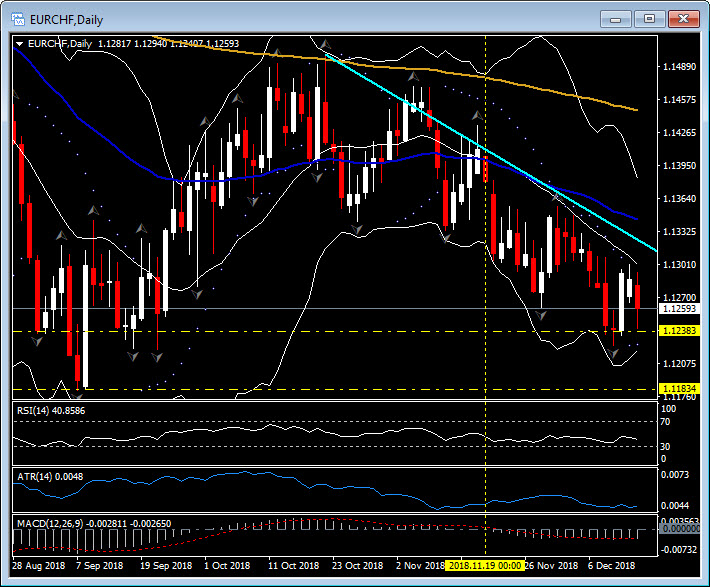

The Dollar has traded firmer against mot other currencies, the Yen being the main exception, with USDJPY having held steady in the mid 113.0s. Driving were weakness in Dollar block currencies, amid a backdrop of tumbling stock markets and sub-forecast Chinese retail sales and production data, and specific weakness in both the Euro and the Pound. EURUSD has posted its biggest drop of the month so far, falling over 0.6% in making a 16-day low at 1.1281. EURJPY concurrently printed an eight-day low and EURCHF has tumbled back toward recent two-and-a-half-month lows. The Euro selling catalyst was disappointing preliminary December PMI data out of the Eurozone, where the composite reading fell to a 49-month low of 51.3, down quite sharply from November’s 52.7 reading. This data feeds the narrative in markets of a Eurozone economy losing growth momentum, which coupled with concerns about the various populist political movements in Europe – of which the riots in France, budget planning woes in Italy and Brexit are all symptomatic of – is making the Dollar a preferable alternative to the Euro, despite the recent recalibration in Fed policy expectations.

EURUSD has next support at 1.1265, which is the S3 and the H4 low from November 14. The November low was 1.1215. Resistance is now S1 at 1.1326, the 20-period moving average at 1.1342 and the daily pivot and 200-period moving average at 1.1360.

Click here to access the HotForex Economic calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.