FX News Today

Asian Market Wrap: 10-year Treasury yields fell back 2.5 bp to 2.944%, 2-year yields are trading at 2.807%, and the 5-year is actually marginally lower at 2.801%. 10-year JGB yields are down -1.0% at 0.063%. Stock markets declined in Asia and risk aversion is back in full swing. The relief rally over the US-China “deal” petered out amid doubts that this really will be the end of the trade tensions. The yield curve also added to concerns about the outlook for the world economy and the risk of recession, as central banks try to keep an upbeat tone. The RBA left the official cash rate unchanged today, and while Australia’s central bank doesn’t seem in a rush to hike rates, it welcomed a pick up in wage growth, which ultimately should see rates moving higher. The ASX dropped -1.01% today as Topix and Nikkei also underperformed with losses of around 2.4% each as a stronger Yen added to pressure. Hang Seng and mainland China indices continued to outperform with the Shanghai and Shenzhen Comp managing modest gains of 0.19% and 0.26% respectively. Oil prices remained supported and are holding above USD 53 per barrel ahead of the OPEC meeting which traders hope will bring supply cuts.

European Fixed Income Outlook: The 10-year Bund future opened at 161.91, up from 161.50 at the close Monday. The cash yield is down -2.1 bp at 0.282%, against a -1.5 bp drop in 10-year Treasury yields, which are trading at just 2.953%. Yesterday’s rally on stock markets quickly petered out as the relief over the US-China agreement gave way to concerns that this won’t have been the last of global trade tensions and concern over the outlook for world growth. Equities were broadly lower in Asia and US futures as well as European stock futures are also heading south. Central banks are still putting on a brave front and Bundesbank President Weidmann once again called for swift policy normalisation, but even he stressed that this will be data dependent and recent releases suggest that hopes of a quick rebound from the weakness over the summer will be disappointed. Italy jitters eased somewhat amid further reports that the government is working on a compromise with the European Commission, but Brexit risks and the ongoing violent protests in France are adding to the risk backdrop. The data calendar is relatively quiet, but includes Swiss inflation data, as well as the UK Construction PMI and Eurozone PPI inflation.

Charts of the Day

Main Macro Events Today

- Swiss Consumer Price Index – The November CPI is expected to have grown by 1% y/y in Switzerland, which could signal how GDP is expected to fare in the last quarter of the year, following a 0.2% reduction in real GDP in Q3.

- UK Construction PMI – UK PMI is expected to have declined to 52.5 compared to 53.2 last month, albeit still signalling growth.

- FOMC Member Williams Speech – FOMC Member Williams is set to speak on local employment and labour force terms in New York.

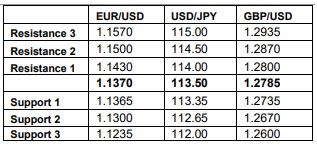

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.