FX News Today

European Fixed Income Outlook: The December 10-year bund future opened at 161.00 little changed from the 161.02 at yesterday’s close. The 10-year cash yield is down -0.3 bp at 0.345% in opening trade. Treasury and JGB rates, meanwhile, are up 0.8 bp at 0.5 bp respectively, as stock market sentiment got a boost from confirmation of a dinner meeting between Trump and Xi Jinping that boosted hopes of a truce on trade. In Europe, there were media reports that the US could impose auto tariffs as early as next week, with Brexit and Italy jitters also clouding over market sentiment. Released at the open, German GfK consumer sentiment fell back more than expected, although at 10.4 it still remains at very high levels. Yet to come, today’s calendar has Eurozone M3 money supply growth, as well as supply from Germany and Italy and another round of ECB speakers.

Asian Market Wrap: 10-year Treasury yields are up 0.5 bp at 3.063%, the 10-year JGB rate is up 0.9 bp at 0.090%. Stock markets move cautiously higher on Wednesday as the Dollar strengthened and risk assets came back, with traders waiting for the G-20 and signs on the future of US-Sino relations. Trump may have dampened hopes that planned tariffs will be postponed, but White House adviser Kudlow confirmed a dinner meeting between Trump and Xi Jinping in Argentina, which lifted hopes of a deal. The fact that markets are moving on hopes and speculation also means, however, that volatility is likely to remain high as one headline can change the direction of markets. Topix and Nikkei gained 0.58% and 1.02%, Shanghai and Shenzhen Comp are up 0.75% and 0.93%. The ASX underperformed with a loss of -0.08%, with losses from major material stocks pushing the market into negative territory. US futures are moving higher though, as are oil prices. The front end Nymex future is trading at USD 52.35 per barrel as traders are looking to the OPEC meeting next week, with hopes of measures to curb supply.

Charts of the Day

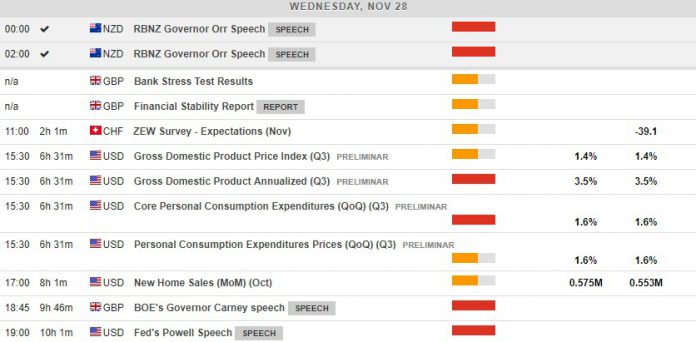

Main Macro Events Today

- UK Bank Stress Test Results – Stress tests test the banking sector’s ability to withstand severe shocks to the economy. Banks which do not pass the tests are forced to either increase their capital base or proceed with other measures. All the above add more pressure to the overall system. Similarly, the Financial Stability Report is expected to provide BoE’s view on inflation and growth in the UK.

- US GDP and PCE Prices Q3 – The third quarter GDP release is expected to come out at the same level as last quarter, standing at 3.5% at an annualised rate. Personal Consumption Expenditure (PCE) Prices is expected to stand at 1.6% q/q, same as last quarter.

- New Home Sales – New home sales are expected to come out higher than September, at 0.575 mln compared to 0.553 mln.

- Mark Carney and Jerome Powell Speeches – Both Central Bank heads are expected to talk on the same topic – financial stability – with the former as part of the Financial Stability Report and the latter at the economic club of New York.

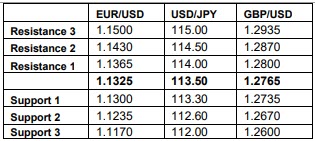

Support and Resistance

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.