EURJPY & EURUSD

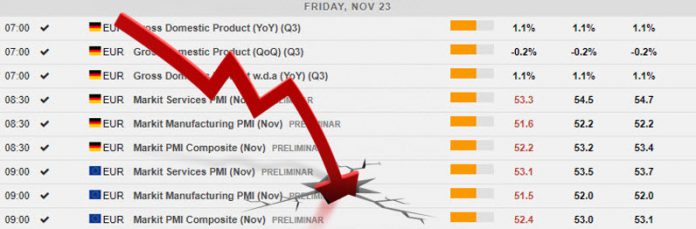

Eurozone preliminary Nov PMIs disappoint – again. The weak German readings had already sent Bund yields lower ahead of the overall Eurozone number, which not surprisingly also came in lower than anticipated.

The German manufacturing sector failed to recover as hoped and the flash Eurozone output index for the manufacturing sector fell back to a 65-month low, while the manufacturing PMI was at a 30-month low of 51.5, down from 52.0 in October. The Services PMI fell back to 53.1 from 53.7 and the composite came in at 52.4, down from 53.1 in October and a 47-month low.

Markit reported that the weakness in the flash reading reflects slowing order books growth and a drop in exports. A new index for export orders across manufacturing and services sectors that was released for the first time this month, was actually at the lowest level in the 4-year history calculated by Markit. The backlog of orders picked up only marginally, which means capacity constraints are easing. Still, while the headline numbers are disappointing, the latter report on the backlog of work highlights that this is still a slowdown in growth, rather than a contraction and that capacity utilisation remains at high levels.

Therefore the data are unlikely to prevent the ECB from confirming the phasing out of QE in December, but they will add to the arguments of the doves around Draghi who remain very reluctant to talk about rate hikes any time soon.

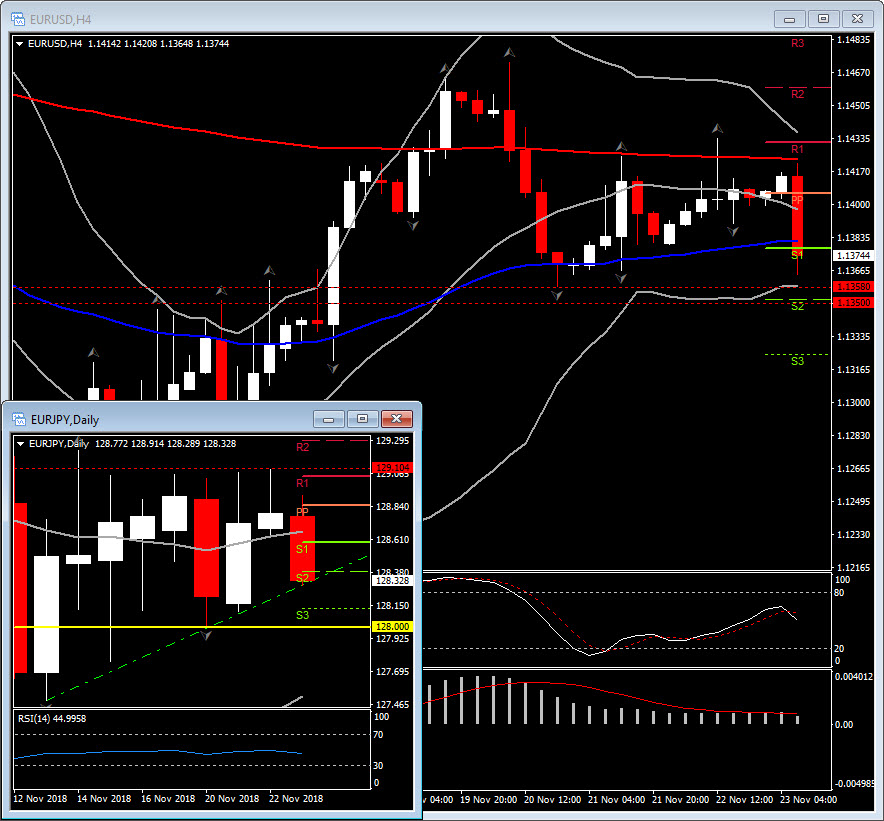

The Euro has tumbled on the German and Eurozone PMI miss, with EURUSD reversing 2-day gains and dropping over 40 pips in making a low of 1.1364 (retesting 20-day SMA). The week’s low, seen on Tuesday, is at 1.1358. As the data adds to signs of flagging growth momentum in the Eurozone, the recent abatement in Fed tightening expectations has been keeping the pair buoyed after last week posting a 17-month low at 1.1215, but concerns about Italian 2019 budget and Brexit uncertainty have been concurrently reining in upside potential. Support is at 1.1350-1.1358, and Resistance 1.1430-1.1435.

EURJPY has posted a low at 128.28, which is 17 pips shy of Wednesday’s low. Significant is the fact that it broke the 20-day SMA at 128.66. It is sustains losses within the lower Bollinger band area, then the next immediate support for the pair is set at the round 128.00 level which coincides with the latest daily fractal and Tuesday’s low. Resistance remains for a 7th day at 129.10, while the intraday Resistance holds at 128.66.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.