EURGBP, H4 and Daily

Sterling has lifted moderately after BoE Governor Carney hinted that rates may go up in the case of a no-deal Brexit scenario, even though this is something he has pointed to before and the Brexit picture in the UK remains as clear as mud.

Carney put pressure on Gilts, and helped Pound. BoE Governor Carney hinted that rates may go up even in the case of a no-deal Brexit scenario, which is something he has pointed to before. Carney said that “if the economy moved further into excess demand” and “Sterling were to depreciate at a time where we had some expectation of supply being reduced for a period of time, that’s a situation where you would expect – at least I would expect – that monetary policy would be tightened”.

The 10-year Gilt yield is at intraday highs of 1.390%, up 1.7 bp, and the 2-year is up 1.9 bp. Cable lifted out of intraday lows under 1.2830 to an intraday high of 1.2884. However, in the wider picture Cable is underperforming with 3-day Resistance holding strongly at the 1.2880-1.2892 area.

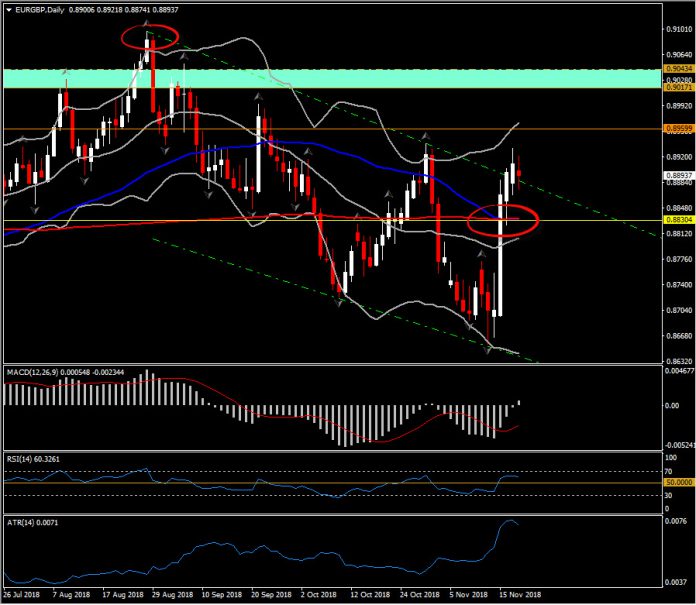

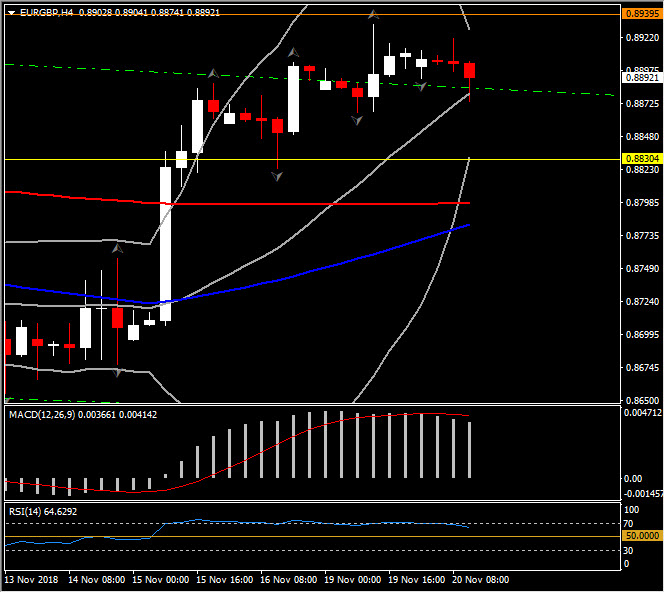

Interestingly, on the boost of Pound from Carney’s speech, EURGBP turned to 0.8874, retesting the upper line of the descending triangle seen since the end of August. However this turn lower followed the break of the triangle in yesterday’s session. Hence the pair is currently in a “wait and see” stance, as the break of the triangle raises hopes for an increase of the bullish bias, but on the other hand today’s reversal could alert the continuation of the 3-month down channel.

Meanwhile, the current picture of EURGBP suggests that the 4-day upwards movement is running out of steam, after rejecting the Resistance set at October’s peak and posting a new lower high. The bearish bias also complies with the intraday and daily momentum indicators which present weakness in the near term. RSI is slipping lower from its 64 high but remains above 50, while the MACD oscillator turned positive but its signal line remains in the negative territory and well below the neutral zone. Something that suggests that strength might be temporary.

The upside swing is supported at yesterday’s low at 0.8866, and it can find Resistance at 0.8935-0.8940. If the pair sustains its move above the triangle’s upper line and 0.8900 hurdle, a decisive break of October’s peak at 0.8940, the doors could be opened for the 0.9030-0.9085 barrier.

Meanwhile, as Sterling seems unable to sustain itsgains given the prevailing Brexit funk, in the case that EURGBP extends its losses, then immediate Support is set at the clash of 50- and 200-day SMA at 0.8830. On the break below this Support level, the next handles are at Thursday’s bottom at 0.8695.

From the Brexit perspective, Brexit debate continues to dominate headlines, with UK Prime Minster May and her allies continuing to hard-sell her Brexit plan in the face of ongoing strong opposition. She was dealt a fresh blow after backbencher members of parliament forced the government to agree to publish analysis comparing the economic impact of her Brexit deal with the alternate scenarios of staying in the EU or leaving without a deal. Previously leaked documents suggest that the analysis will show that remaining in the EU would be economically better, in turn suggesting that the report would garner support for another referendum, which Remain campaigners seek. Spain has also threatened to reject a deal unless Madrid is given a special veto to prevent a future trade deal that covers Gibraltar.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.